In an age where convenience reigns supreme, the way we handle our finances is evolving more rapidly than ever before. If you’ve ever found yourself frustrated by the lengthy process of online payments—filling out forms, waiting for confirmations, and worrying about security—you’re not alone. But what if I told you there’s a simpler, faster, and more secure way to transfer money online? Enter direct bank transfers! This game-changing method is revolutionizing how we pay for everything from groceries to gadgets, making transactions smoother and more efficient. In this article, we’ll dive into the world of direct bank transfers, exploring how they are not onyl reshaping our online payment experiences but also setting new standards for security and ease. So, whether you’re a tech-savvy millennial or someone just trying to navigate the digital payment landscape, buckle up! You’re about to discover why direct bank transfers might just be the future of online payments.

The Rise of Direct Bank Transfers in Online Payments

The digital payments landscape is evolving, and direct bank transfers are at the forefront of this transformation. as consumers seek faster, more secure ways to manage their finances online, traditional payment methods are increasingly being overshadowed by this efficient choice. With a direct bank transfer,users can send and receive funds directly from their bank accounts,bypassing the need for third-party processors,which often come with additional fees and security concerns.

One of the most compelling advantages of direct bank transfers is their cost-effectiveness. Unlike credit card transactions that may incur processing fees, bank transfers typically have lower or no fees at all. This becomes particularly advantageous for businesses that operate on thin margins and rely on maximizing profit.By adopting direct bank transfers, companies can redirect savings towards enhancing their services or passing on the benefit to their customers.

Moreover, the security of online transactions is paramount, and direct bank transfers provide a level of protection that is increasingly appealing to consumers. With advanced encryption techniques and robust authentication protocols, customers can rest assured that their sensitive financial information remains secure. This growing trust in direct transfers is evident in the rising number of users opting for this method, especially for larger transactions where security is a major concern.

As direct bank transfers gain traction, we can observe a shift in consumer behavior. Here are a few notable trends:

- Increased Adoption: More online retailers are integrating direct bank transfer options, enhancing customer convenience.

- Consumer Preference: Customers are increasingly preferring direct transfers for their simplicity and reliability.

- Enhanced Mobile Banking: As mobile banking apps become more sophisticated, users are more inclined to use direct transfers on-the-go.

To illustrate the growth of this payment method, consider the following table that highlights the rise in direct bank transfer usage over recent years:

| Year | Percentage of Users | Growth Rate |

|---|---|---|

| 2020 | 25% | – |

| 2021 | 35% | 10% |

| 2022 | 50% | 15% |

| 2023 | 65% | 15% |

As this trend continues, it’s clear that direct bank transfers are not just a passing fad.They represent a basic shift in the way we approach online payments, paving the way for a more streamlined, cost-effective, and secure payment experience. Embracing this method is not just beneficial for consumers; businesses that adapt to these changes will position themselves favorably in an increasingly competitive market.

Understanding the Benefits of Direct Bank Transfers for Consumers

Direct bank transfers are revolutionizing the way consumers handle transactions online. One of the most significant advantages of this method is its speed. Unlike traditional payment methods that can take a few days to process, direct bank transfers are often instantaneous, allowing consumers to complete their purchases without unnecessary delays.

Another crucial benefit is security. With direct bank transfers, sensitive information is kept within the banking system, reducing the risk of fraud associated with credit card payments and third-party payment processors. When consumers choose this method, they can enjoy peace of mind, knowing their financial details are less likely to be compromised.

Cost-effectiveness is also a key factor driving the adoption of direct bank transfers. Many banks offer this service at little to no cost, which can be a stark contrast to the fees that often accompany credit card transactions and online payment services. This can lead to significant savings for consumers,especially for frequent shoppers or those making larger purchases.

Moreover,direct bank transfers provide enhanced control over spending. Consumers can link their bank accounts directly to their purchasing habits,allowing for easier management of budgets. This method encourages responsible spending by giving users a clearer view of their financial health at any given moment.

| Benefit | Description |

|---|---|

| Speed | Instant transactions that eliminate delays. |

| Security | Lower risk of fraud with sensitive information protected. |

| Cost-effectiveness | Lower fees compared to credit card transactions. |

| Control | Easier budgeting and financial tracking. |

Lastly, the growing acceptance of direct bank transfers by e-commerce platforms enhances their practicality. As more businesses implement this payment option, consumers find it increasingly convenient to choose direct bank transfers, creating a positive feedback loop that benefits both parties. This change is not just a trend; it’s a fundamental shift in how we view online payments, paving the way for a more efficient and secure financial landscape.

Why businesses are Embracing Direct Bank Transfers

As more businesses seek efficient ways to streamline their financial transactions, direct bank transfers are quickly becoming a preferred method of payment. This shift is not merely a trend; it reflects a fundamental change in how companies approach cash flow management and customer convenience.

One of the primary reasons businesses are adopting direct bank transfers is the reduction in transaction fees. Unlike credit card payments,which often carry hefty processing fees,bank transfers typically come with lower costs,allowing businesses to retain more of their revenue. This is particularly beneficial for small and medium-sized enterprises (SMEs) that operate on thin margins and are always on the lookout for ways to cut costs.

Additionally, direct bank transfers offer speed and efficiency. Funds can be transferred almost instantaneously, allowing businesses to access their money without the delays associated with traditional payment methods. This immediacy not only enhances cash flow but also improves the overall customer experience, as clients appreciate the fast turnaround times on their transactions.

Another compelling advantage is the increased security that comes with direct bank transfers. With the rise of online payment fraud, businesses are increasingly wary of sharing sensitive customer information with third-party processors. Direct bank transfers minimize these risks, as they do not require customers to input their card details, thus reducing the chances of information theft.

The trend towards embracing direct bank transfers also aligns with a growing preference for digital banking. As more consumers and businesses move towards cashless transactions,the infrastructure supporting direct transfers—like mobile banking apps and online platforms—has improved significantly. This technological advancement contributes to a smoother and more user-kind payment process.

| Benefits of Direct Bank Transfers | Impact on Businesses |

|---|---|

| lower Transaction Fees | More revenue retained |

| Faster Transactions | Improved cash flow |

| Enhanced security | Reduced risk of fraud |

| Digital Integration | Simplified payment processes |

How direct Bank Transfers Enhance Security in Online transactions

In an era where digital fraud is rampant, the need for secure payment methods has never been more crucial. Direct bank transfers stand out as a robust solution in online transactions, significantly enhancing security for both consumers and businesses.Unlike credit card payments, which are frequently enough vulnerable to phishing attacks and identity theft, direct bank transfers offer a more stable and secure alternative.

One of the primary advantages of using direct bank transfers is the reduced risk of chargebacks. With traditional payment methods, customers can dispute transactions, leading to potential losses for businesses.In contrast, direct bank transfers are final once initiated, minimizing the chances of fraudulent claims and ensuring that funds are securely deposited into the recipient’s account. This finality not only protects businesses but also fosters trust in the transaction process.

Moreover, direct bank transfers often utilize advanced encryption protocols, safeguarding sensitive financial information from malicious attacks. When you make a transfer, yoru banking details are encrypted, meaning that even if a cybercriminal intercepts the data, they cannot exploit it. This added layer of security reassures consumers, encouraging them to engage in more online transactions without fear of their financial information being compromised.

Here’s a quick comparison of direct bank transfers versus credit card transactions:

| Feature | Direct Bank Transfers | Credit Card Transactions |

|---|---|---|

| Fraud Risk | Low | High |

| Chargeback Issues | None | Common |

| Transaction Fees | Generally Lower | Higher |

| Speed of Transfer | Instant or Same-day | Immediate |

Additionally, direct bank transfers can contribute to better budgeting and financial management for users. By linking a bank account directly to payment services, consumers can avoid overspending and the potential pitfalls of credit card debt. With every transaction being directly deducted from their account, users can develop a clearer understanding of their spending habits, leading to improved financial health.

the adoption of direct bank transfers not only provides enhanced security but also creates a more streamlined and trustworthy online payment ecosystem. As consumers become more aware of the risks associated with online transactions, embracing direct bank transfers will likely become a preferred choice, ensuring that safety and convenience go hand in hand.

Navigating Fees and Costs: The Financial Upside of Direct Transfers

In the evolving landscape of online payments, direct bank transfers are making waves not just for their convenience but also for their cost-effectiveness. By bypassing traditional payment processors, users can enjoy a host of financial benefits that make direct transfers an increasingly attractive option. Here’s how they can save you money and streamline your transactions.

Lower Fees: One of the most significant advantages of direct bank transfers is the reduction in fees. Traditional payment methods frequently enough involve hefty processing fees, which can add up quickly, especially for businesses handling large volumes of transactions. With direct transfers,these costs are minimized or even eliminated altogether. This means:

- No percentage-based fees on every transaction

- Flat-rate charges or none at all

- Cost savings that can be reinvested in your buisness

Faster Access to Funds: Speed is another crucial factor. Direct transfers typically result in quicker access to your funds compared to conventional methods that may take days to clear. This immediacy can enhance cash flow, making it easier to manage day-to-day expenses or capitalize on time-sensitive opportunities. Consider the following:

- Instant availability of funds for daily operations

- Reduced waiting times for larger payments

- Enhanced financial flexibility to respond to market demands

Transparency in Costs: Direct transfers promote a clearer understanding of transaction costs. Users can easily track their expenses without the hidden charges often associated with third-party services.This transparency fosters trust and allows businesses to anticipate their financial commitments without surprises. Here’s how it plays out:

- Clear breakdown of transaction costs

- Easier budgeting for both consumers and businesses

- Fewer disputes over unexpected charges

as more businesses adopt direct bank transfers, the competitive landscape may push overall transaction costs down, benefiting everyone involved. The potential for a win-win scenario exists, where both consumers and businesses can thrive without the burden of excessive fees. Embracing this payment method could not only simplify transactions but also enhance your financial health in the long run.

Streamlining the payment Process: Speed and Efficiency Redefined

In today’s fast-paced digital landscape, the demand for swift and efficient payment methods has never been higher. Direct bank transfers, often overlooked, are emerging as a powerful solution that can significantly enhance the online payment experience. Unlike traditional methods that can be bogged down by delays and fees, direct bank transfers offer a seamless approach that ensures your money moves faster than ever.

When it comes to online payments, the benefits of direct bank transfers are clear:

- Instant Transactions: Many banks now facilitate real-time settlements, meaning your funds can arrive in mere minutes.

- Lower Fees: By bypassing intermediaries, both businesses and consumers can save significantly on transaction fees.

- Enhanced Security: Direct bank transfers reduce the risk of fraud, as they require authentication through secure banking channels.

- Simplified Process: Forget about entering card numbers or dealing with complex gateways; a direct bank transfer allows for a straightforward transaction.

Furthermore, direct bank transfers contribute to better cash flow management for businesses. With fewer delays in receiving payments, companies can reinvest funds quickly, allowing for growth and improved service offerings. This advantage is especially critical for small to medium-sized enterprises (SMEs) looking to maintain agility in a competitive market.

To illustrate the efficiency of direct bank transfers, consider the following comparison between traditional payment methods and direct bank transfers:

| Payment Method | processing Time | Average Fees | Security Level |

|---|---|---|---|

| Credit/Debit Card | 1-3 Business Days | 2-3% Per Transaction | Moderate |

| PayPal | Instant | 3-5% Per Transaction | High |

| Direct Bank Transfer | Instant (or Same Day) | Minimal to None | Very High |

As consumers become more tech-savvy and demand greater efficiency, businesses are increasingly adopting direct bank transfers as a primary payment method. This shift not only meets customer expectations but also promotes a more lasting and cost-effective payment ecosystem. Embracing this method can be a game-changer, allowing businesses to redefine their financial transactions in a way that prioritizes speed and efficiency.

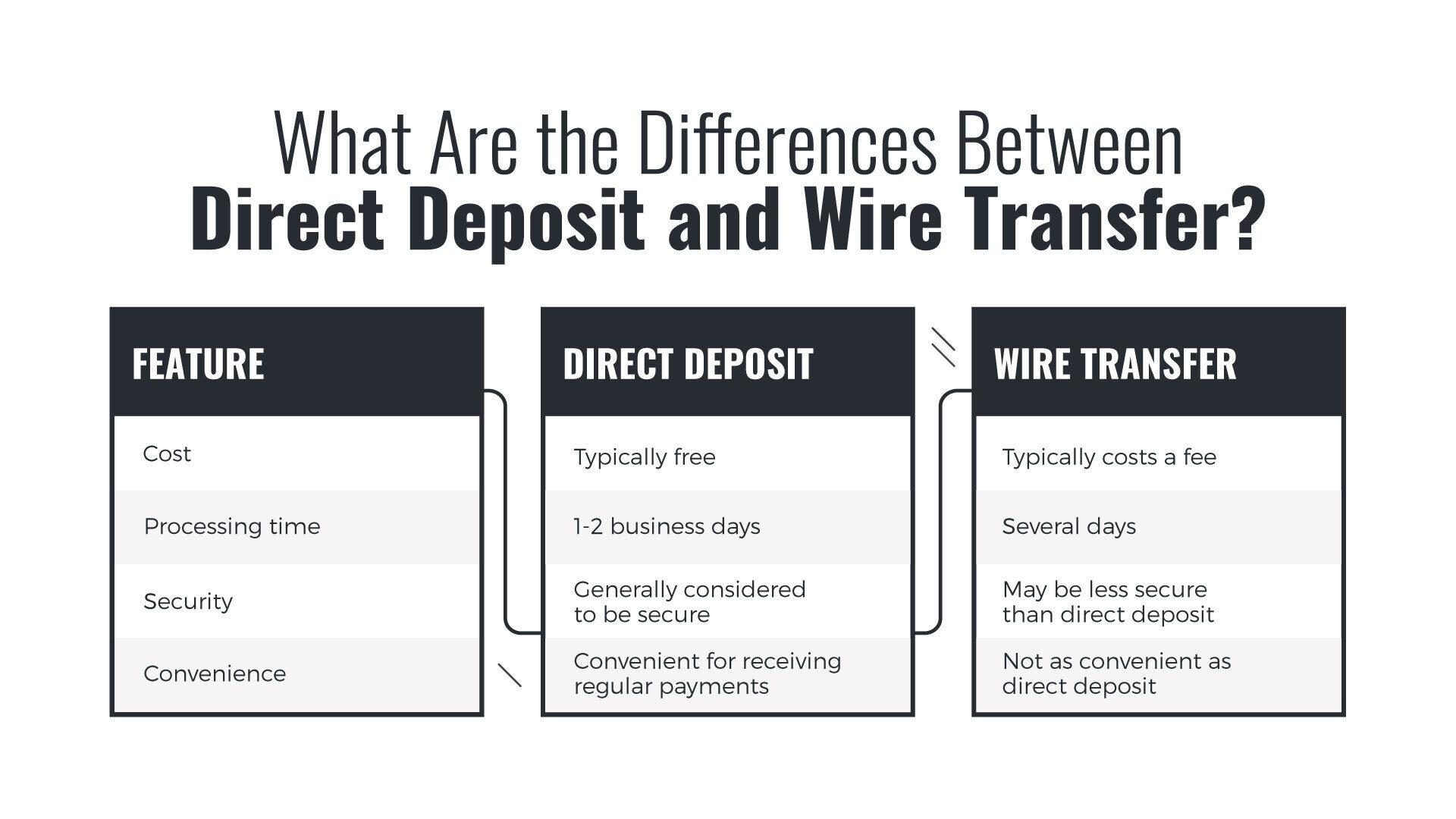

Direct Bank Transfers Versus Traditional Payment Methods

As the digital landscape continues to evolve, direct bank transfers have emerged as a revolutionary payment option, reshaping the way consumers and businesses conduct transactions online. unlike traditional payment methods, which often involve intermediaries and additional fees, direct bank transfers simplify the payment process, offering both speed and security.

One of the standout advantages of direct bank transfers is their cost-effectiveness. Many traditional payment methods,such as credit cards or digital wallets,impose transaction fees that can add up quickly,especially for businesses. Direct transfers, on the other hand, frequently enough have lower or no fees associated, making them a more appealing choice for both buyers and sellers. this direct approach eliminates the middleman, streamlining transactions and allowing businesses to keep more of their earnings.

Moreover, the speed of transactions is significantly improved with direct bank transfers. Traditional payment methods can take days to process, particularly if international transactions are involved. In contrast, many direct transfers are completed almost instantly or within a few hours, providing immediate access to funds. This is especially beneficial for businesses that rely on quick cash flow to maintain operations and fulfill customer needs.

Security is another critical factor where direct bank transfers shine. With traditional methods, users frequently enough have to share sensitive financial information with multiple entities, increasing the risk of fraud. Direct transfers leverage bank-level security protocols, minimizing exposure to potential breaches.Customers can feel confident knowing their money is being transferred directly between bank accounts without the need for third-party involvement.

| Feature | Direct Bank Transfers | Traditional Payment Methods |

|---|---|---|

| Transaction Fees | Low or None | Higher Fees |

| Processing Speed | Instant to Few Hours | 1-3 Days |

| Security | High (Bank-level) | Variable |

| User Control | high | Medium |

the rise of direct bank transfers is not just a trend; it represents a fundamental shift in how we approach online payments. With their ability to cut costs,increase transaction speeds,and enhance security,direct transfers are setting a new standard for financial transactions. As more consumers and businesses recognize these benefits, it’s clear that this payment method is here to stay, driving a more efficient and secure online economy.

Future Trends: What’s Next for Direct Bank Transfers in E-Commerce

As the digital landscape evolves, direct bank transfers are poised to transform the e-commerce payment ecosystem. With growing concerns around security and the increasing demand for seamless transactions, more businesses are looking to integrate this payment method into their platforms. Here are some anticipated trends that will shape the future of direct bank transfers in online shopping:

- Enhanced Security Protocols: With cyber threats on the rise, banks are investing in sophisticated security measures. Expect to see innovations like biometric authentication and blockchain technology becoming standard in direct bank transfers, providing merchants and consumers with peace of mind.

- Instant Payments: The demand for immediate transactions is escalating. As financial institutions upgrade their infrastructures, we can look forward to real-time processing of bank transfers, which will significantly reduce the waiting times associated with traditional methods.

- Integration with E-Wallets: As e-wallets gain popularity, banks are likely to forge partnerships that allow users to link their accounts for direct bank transfers.This synergy will enhance user experience by combining the best of both worlds.

- Global Reach: Direct bank transfers are expected to become more internationally accessible. With improved cross-border regulations and the adoption of multi-currency options, shoppers will enjoy frictionless payment experiences nonetheless of their location.

Moreover,businesses are expected to leverage data analytics to understand consumer behavior better. By analyzing transaction patterns, they can tailor their offerings and enhance customer loyalty. Direct bank transfers will provide valuable insights that can drive marketing strategies and personalized shopping experiences.

| Trend | Impact on E-Commerce |

|---|---|

| Enhanced Security | Boosts consumer confidence |

| Instant Payments | Improves transaction efficiency |

| Integration with E-wallets | Streamlines payment processes |

| Global Reach | Expands customer base |

Ultimately, the future of direct bank transfers in e-commerce is radiant. As these trends take shape, businesses that adapt quickly will not only enhance their operational efficiency but also improve their overall customer satisfaction. By embracing these changes, they can stay ahead in the competitive digital marketplace.

Making the Switch: Tips for Adopting Direct Bank Transfers in Your Business

Transitioning to direct bank transfers offers a seamless and efficient way to manage your business transactions. Here are several strategies to facilitate this transition:

- Evaluate Your Current Payment Systems: Take stock of your existing payment systems. Identify the pain points and inefficiencies that direct bank transfers could alleviate. Consider transaction fees, processing times, and customer satisfaction.

- Educate Your Team: Ensure that everyone involved in financial transactions understands how direct bank transfers work. Offer training sessions to familiarize them with the new process, emphasizing its advantages.

- communicate with Customers: Keep your customers informed about the switch. Provide clear instructions and support to ease their transition. Address any concerns they may have about security or convenience.

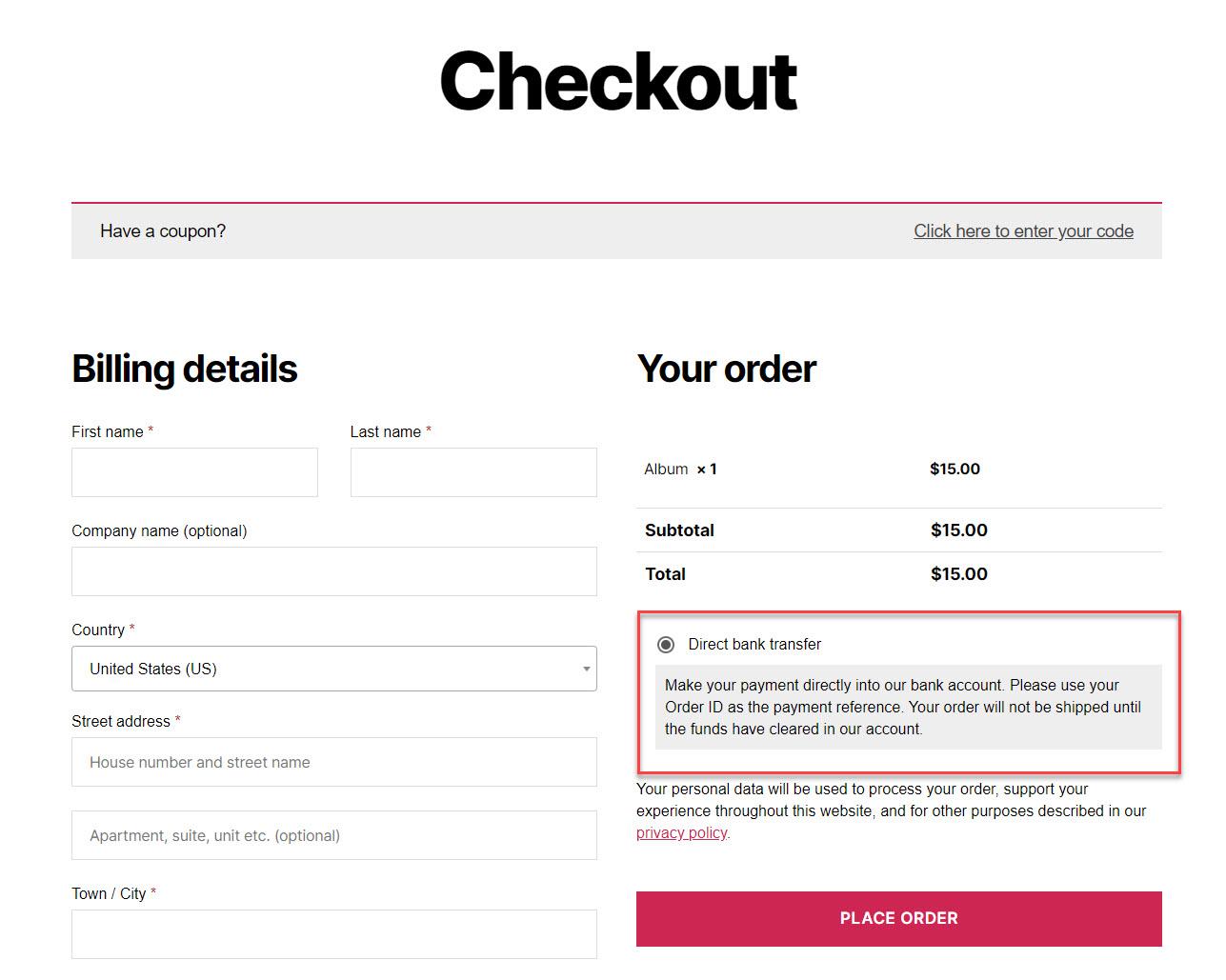

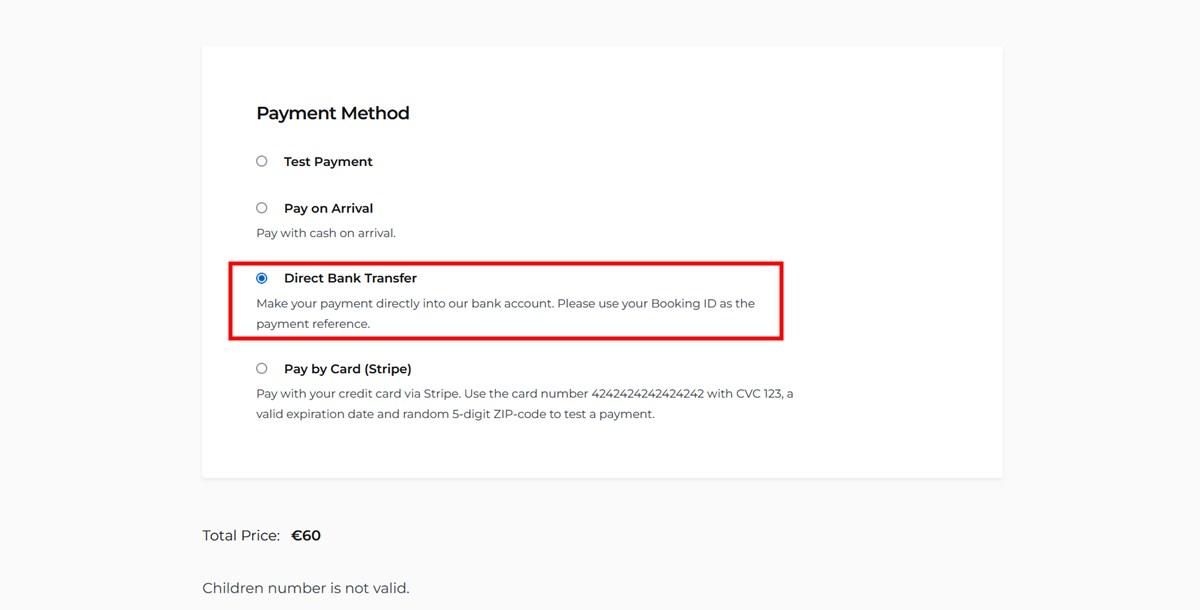

- Update Your Website: Make necessary updates to your online payment options. Clearly display the direct bank transfer option and guide users through the process. A user-friendly interface can enhance customer experience.

- Implement Security Measures: Security is paramount when handling sensitive financial information. Invest in robust encryption methods and ensure compliance with regulations to protect both your business and customers.

To illustrate the benefits of direct bank transfers, consider the following comparison of traditional payment methods versus direct bank transfers:

| Feature | traditional methods | Direct Bank Transfers |

|---|---|---|

| Transaction Fees | Frequently enough High | generally Low |

| Processing Time | 1-3 Days | instant to 24 Hours |

| security | Variable | High |

| User Experience | Can Be Complicated | Simplified Process |

Emphasizing these advantages in your marketing materials can definitely help persuade reluctant customers to make the switch. As you implement direct bank transfers, monitor your transaction success rate and customer feedback. This will help you make any necessary adjustments and continue optimizing your payment process.

Lastly, consider offering incentives to customers who choose direct bank transfers, such as discounts or loyalty points. This not only encourages adoption but also enhances customer satisfaction, ultimately benefiting your bottom line.

Empowering Consumers: The Impact of Direct Bank transfers on Personal Finance

In recent years, direct bank transfers have revolutionized the way consumers execute online payments, offering a seamless and efficient alternative to traditional methods. This shift is not just about convenience; it empowers consumers by providing greater control over their finances. With direct bank transfers, individuals can manage their spending more effectively, reducing reliance on credit cards and minimizing the risk of debt accumulation.

One of the most significant benefits of direct bank transfers is the level of security they offer. Unlike credit card transactions, which can be susceptible to fraud, direct transfers use bank-level encryption and authentication processes. This not only helps protect personal information but also fosters trust between consumers and merchants.When consumers feel secure about their transactions, they are more likely to engage in online shopping, leading to increased business for merchants.

Moreover, direct bank transfers often come with lower fees compared to credit card processing. This means that consumers can save money on transaction costs, which can add up over time. For businesses, the reduced fees translate to higher profit margins, allowing them to invest back into their operations or pass on savings to customers. Here’s a quick comparison of typical fees:

| Payment Method | Average Transaction Fee |

|---|---|

| Credit Card | 2.5% – 3.5% |

| Direct Bank Transfer | 0.5% – 1.5% |

the convenience factor cannot be understated either. With direct transfers, payments can be made instantly, without the need for waiting on bank approvals or processing times associated with checks. This immediacy enhances the overall shopping experience,allowing consumers to complete transactions quickly and efficiently. As more platforms adopt this payment method, it becomes clear that consumers prefer the simplicity and speed of direct transfers.

Ultimately, the rise of direct bank transfers signifies a shift in consumer behavior towards more mindful spending. By leveraging this method, individuals can track their finances with greater transparency and make more informed decisions. The empowerment derived from direct bank transfers is transforming personal finance, enabling consumers to take charge of their financial futures in ways that were previously challenging.

Frequently Asked Questions (FAQ)

Q&A: How Direct Bank Transfers Are Changing the Way We Pay Online

Q: Why are direct bank transfers becoming so popular for online payments?

A: Great question! Direct bank transfers are gaining traction because they offer a seamless and secure way to conduct transactions. Unlike traditional methods that often involve credit card fees or the risk of fraud, direct transfers are typically more straightforward and provide a layer of security that many users appreciate.

Q: What are some advantages of using direct bank transfers for online purchases?

A: There are several advantages! First, they usually have lower transaction fees compared to credit cards, which can save both businesses and consumers money.Second, direct transfers eliminate the need to share sensitive card information, reducing the risk of identity theft. And let’s not forget the speed—many transfers are processed almost instantly!

Q: How do direct bank transfers work for consumers?

A: It’s quite simple! When you choose to pay via direct bank transfer, you typically enter your bank details and authorize the transaction. The money is then transferred directly from your bank account to the seller’s account. It’s a quick process that can frequently enough be done in just a few clicks.

Q: Are there any downsides to using direct bank transfers?

A: Like any payment method, there are some things to consider. While direct transfers are generally secure, they may not offer the same level of buyer protection that credit cards do.If something goes wrong with the transaction—like non-delivery of goods—you might find it harder to get your money back. It’s always significant to make purchases from reputable sellers.

Q: Can businesses benefit from accepting direct bank transfers?

A: Absolutely! For businesses, accepting direct bank transfers can meen lower processing fees, which can significantly impact their bottom line. It also opens up their payment options, making it easier for customers who prefer not to use credit cards. Plus, with the rise of mobile banking, more customers are looking for convenient options, and direct transfers fit the bill perfectly!

Q: What does the future hold for direct bank transfers in online payments?

A: The future looks bright! As more people become aware of the benefits, and as technology continues to evolve, we can expect direct bank transfers to become a more common choice for online payments.With ongoing advancements in security and speed,they could very well surpass traditional methods in popularity.

Q: How can consumers ensure their direct bank transfers are secure?

A: Great question! To keep your transactions secure, always use trusted websites and double-check the URL for security indicators (like HTTPS). It’s also wise to use two-factor authentication where available and to keep your banking information private. Being cautious can help you enjoy the benefits of direct bank transfers without the worry!

Q: Are there other payment methods that might complement direct bank transfers?

A: Definitely! While direct bank transfers are fantastic, they can be even more effective when used alongside other payment methods like digital wallets or buy-now-pay-later services.This way, consumers can choose the option that best fits their needs at any given time, increasing flexibility and convenience.

Feel free to incorporate these questions and answers into your article, and remember to engage your readers by highlighting the benefits and considerations of using direct bank transfers in today’s digital payment landscape!

To Wrap It Up

As we wrap up our exploration of how direct bank transfers are revolutionizing online payments, it’s clear that this approach isn’t just a trend—it’s a game changer.With their convenience, security, and cost-effectiveness, direct bank transfers are setting a new standard for how we handle transactions in our increasingly digital world.

Imagine a future where you can make payments with just a few clicks, free from the hassle of credit card fees or the risk of fraud. This is not a distant dream; it’s happening now. By embracing direct bank transfers, you’re not only simplifying your own payment experience but also supporting a more efficient and transparent financial ecosystem.

So, whether you’re a business owner looking to streamline your operations or a consumer eager for a hassle-free way to shop online, consider making the switch. The benefits are clear, and the time to adapt is now. join the movement towards smarter payments and experience firsthand the ease and reliability that direct bank transfers have to offer. Your wallet—and your peace of mind—will thank you!