In today’s fast-paced digital economy,selecting the right payment gateway isn’t just a choice—it’s a crucial decision that can make or break your business. As we step into 2025, the landscape of online transactions is evolving rapidly, bringing a host of new features, security enhancements, and competitive pricing models. Whether you’re a budding entrepreneur launching your first online store or an established business seeking to upgrade your payment processing system, navigating the myriad options can feel overwhelming. But don’t worry! In this article, we’re diving into the nitty-gritty of the top payment gateway providers for 2025, comparing their features, fees, and flexibility to help you make an informed choice. By the end, you’ll have a clear understanding of wich provider aligns best with your business needs, so you can focus on what really matters—growing your business and delighting your customers. Let’s get started!

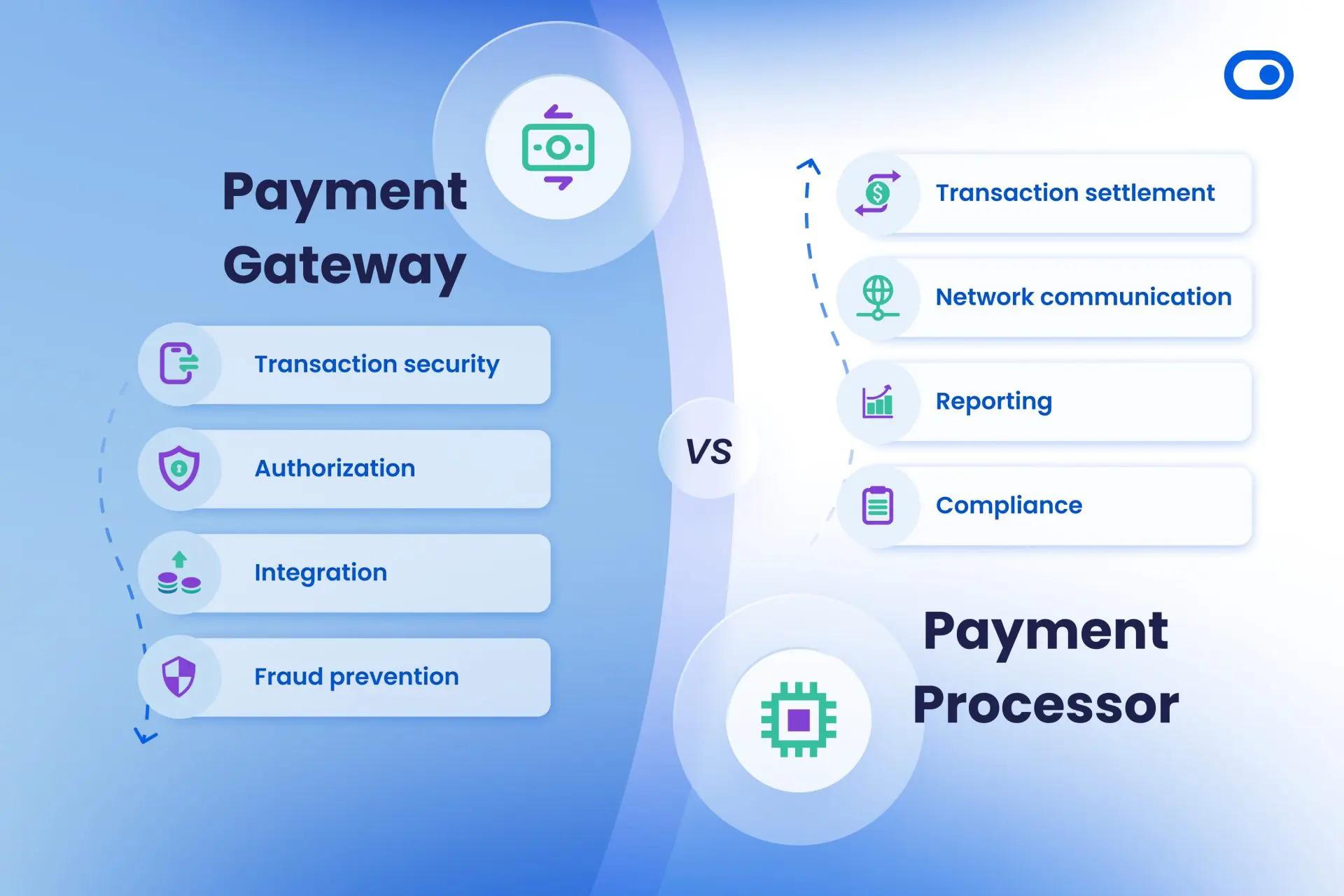

Understanding what Makes a Great payment Gateway

When selecting a payment gateway, understanding the key features that contribute to a seamless payment experience is essential for both businesses and customers. A great payment gateway should not only facilitate transactions but also enhance customer satisfaction and security. Here are some critical elements that define an exceptional payment gateway:

- Security Features: With the rise of online fraud, robust security measures such as SSL encryption, two-factor authentication, and PCI-DSS compliance are non-negotiable. A secure gateway builds trust with customers and protects sensitive data.

- User Experience: A seamless checkout process is crucial.Look for gateways that offer a mobile-pleasant interface, multiple payment options, and a quick transaction time. The easier it is for customers to complete their purchases, the higher your conversion rates will be.

- Integration Capabilities: The ability to integrate with existing e-commerce platforms and APIs is essential. A great payment gateway should work effortlessly with your website and any other tools you use, such as inventory management or customer relationship management (CRM) software.

- Transaction Fees: Understanding the fee structure is vital to your bottom line.Some gateways charge per transaction, while others have monthly fees or a combination of both. Choose one that aligns with your sales volume and business model.

Additionally, having access to detailed analytics can be a game changer. Great gateways provide reporting features that allow you to track sales, refunds, and customer behavior. This data can help you make informed decisions and optimize your payment processes.

| Feature | Importance |

|---|---|

| Security | High |

| User Experience | Very High |

| integration | High |

| Transaction Fees | Medium |

| Analytics | high |

a top-notch payment gateway should combine security, user-friendliness, integration capabilities, transparent fees, and useful analytics. By prioritizing these features, you can ensure that your customers have a smooth and secure payment experience, ultimately driving sales and fostering loyalty.

Key Features to Look for in 2025 Payment Solutions

As businesses evolve in the digital landscape, the importance of choosing the right payment solution becomes paramount. In 2025, a few key features will stand out that can significantly impact your business operations and customer satisfaction. Here are the essential elements to consider:

- Seamless Integration: Ensure that the payment gateway integrates smoothly with your existing systems, including e-commerce platforms, CRM software, and accounting tools. This will reduce setup time and streamline your processes.

- Multi-Currency support: With the rise of global commerce, your payment solution should support multiple currencies. This feature not only enhances customer experience but also expands your market reach.

- Advanced Security Measures: Look for solutions that offer end-to-end encryption, tokenization, and fraud detection tools.These features are crucial for protecting both your business and your customers’ sensitive information.

- User-Friendly Interface: A straightforward and intuitive interface can simplify the payment process for your customers. This can lead to higher conversion rates and improved customer satisfaction.

- Mobile Optimization: In 2025, a notable portion of transactions will occur on mobile devices. ensure that the payment gateway is optimized for mobile to cater to this growing audience.

- Robust Reporting and Analytics: Choose a solution that provides detailed reports and analytics. This will help you track sales trends, measure performance, and make informed business decisions.

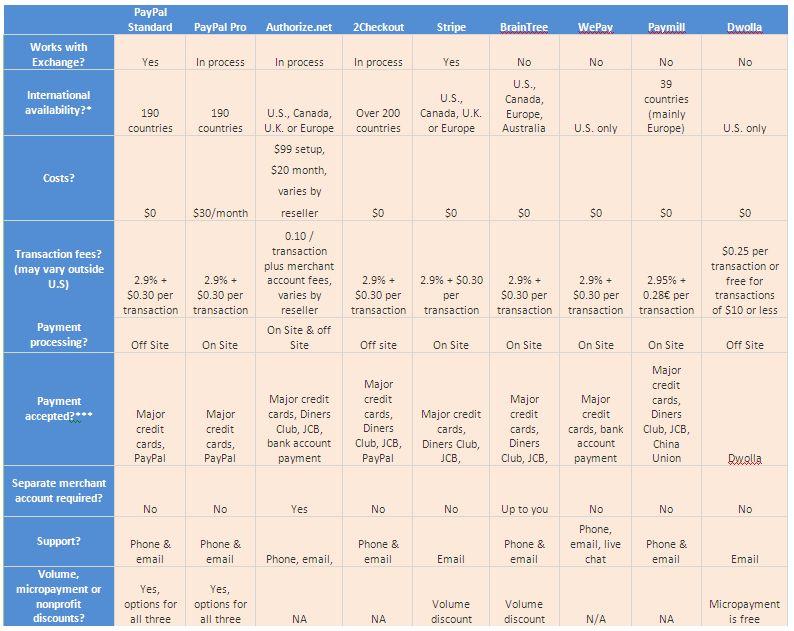

When evaluating different payment solutions, consider creating a comparison table to visualize how each provider stacks up against these essential features. This can definitely help you make a more informed decision based on your specific business needs.

| Provider | Seamless Integration | Multi-Currency Support | Advanced Security | Mobile Optimization |

|---|---|---|---|---|

| Provider A | ✔️ | ✔️ | ✔️ | ✔️ |

| Provider B | ✔️ | ❌ | ✔️ | ✔️ |

| Provider C | ✔️ | ✔️ | ❌ | ✔️ |

| Provider D | ❌ | ✔️ | ✔️ | ❌ |

Ultimately, selecting the right payment solution in 2025 is about more than just processing transactions. It’s about enhancing the overall experience for your customers while ensuring your business operates efficiently and securely. Keep these features in mind as you explore your options, and you’ll be positioned for success in the ever-evolving marketplace.

In-Depth Review of Industry leaders

As we dive into the landscape of payment gateways for 2025, it’s essential to understand what sets the industry leaders apart. Each provider offers unique features tailored to meet diverse business needs,which is why a complete comparison can help you make an informed decision.

Stripe stands out as a favorite among tech-savvy businesses, thanks to its developer-friendly API and extensive integration options. With features such as:

- Real-time analytics: Gain insights into transaction performance.

- Customizable checkout: Tailor the payment experience to your brand.

- Subscription management: Perfect for SaaS models.

Stripe’s ability to seamlessly adapt to various business models makes it a compelling choice for startups and established companies alike.

On the other hand,PayPal retains its dominance due to brand recognition and trust among consumers. Its benefits include:

- Global reach: Available in over 200 countries.

- Buyer protection: Encourages customer confidence.

- Instant payment notifications: Streamline your sales process.

For businesses looking to leverage a trusted name in online transactions, PayPal remains a strong contender.

Square is another notable player, especially for brick-and-mortar establishments that have expanded into e-commerce. Its features include:

- Integrated POS systems: Smooth transitions between online and offline sales.

- Easy setup: Ideal for small businesses without extensive tech resources.

- invoicing tools: simplify billing for services rendered.

Square’s approach to simplifying payment processing is notably appealing to entrepreneurs who want to focus on their core business without getting bogged down by technology.

| Provider | Key Feature | Best For |

|---|---|---|

| Stripe | Developer-friendly API | Tech-oriented startups |

| PayPal | Global reach | Consumer trust |

| square | Integrated POS | Small businesses |

As we consider the future of payment gateways, evaluating these industry leaders based on your specific business needs will empower you to choose the right solution. Whether you prioritize advanced technology, consumer trust, or ease of use, options abound to help your business thrive in the competitive landscape of 2025.

Cost Considerations: Finding the Right Balance

When it comes to selecting a payment gateway, understanding the cost implications is crucial. While it might be tempting to go for the provider that offers the lowest fees, it’s essential to dig deeper and consider the overall value and services provided. A cost-effective solution isn’t just about the transaction fees; it encompasses a wide array of factors that can impact your business’s bottom line.

Here are some key aspects to consider:

- Transaction Fees: These are typically a percentage of each sale plus a fixed amount per transaction. Look for transparency in how these fees are structured, as hidden charges can accumulate quickly.

- Monthly Fees: Some gateways charge a monthly service fee. Assess whether these fees are justified based on the features and support provided.

- Chargeback Fees: Understand how your provider handles chargebacks, as these can significantly affect your costs if not managed properly.

- Currency Conversion Fees: If you’re selling internationally, be aware of the fees associated with currency conversion, which can vary widely between providers.

Moreover,consider the hidden costs that may not be immediately apparent. These can include:

- Integration Costs: Some gateways require extensive integration work, which can lead to unexpected expenses if you’re not prepared.

- Customer Support: Evaluate the quality of customer support.A provider that offers 24/7 assistance may save you money in downtime and lost sales.

- Tools and Features: Many gateways come with additional tools such as fraud protection, analytics, and reporting. These features can enhance your sales strategy and ultimately save you money.

| Provider | Transaction Fee | Monthly Fee | Chargeback Fee | Support |

|---|---|---|---|---|

| Provider A | 2.9% + $0.30 | $0 | $15 | 24/7 |

| Provider B | 3.5% + $0.25 | $20 | $25 | Weekdays |

| Provider C | 2.7% + $0.20 | $10 | $20 | 24/7 |

striking the right balance between cost and value is essential for any business looking to thrive in 2025. By evaluating all aspects of pricing and the additional features each payment gateway offers, you can make a more informed decision that aligns with your business goals. Remember, the cheapest option isn’t always the best one; focus on finding a gateway that provides optimal service while keeping costs manageable.

Security First: How to choose a Safe Payment Gateway

When selecting a payment gateway,security should be your top priority. In an era where data breaches and online fraud are rampant, customers expect their credit card information and personal data to be safeguarded. Here are some key considerations to keep in mind:

- Encryption Standards: Ensure that the payment gateway uses advanced encryption technologies, such as TLS (Transport Layer Security), to protect sensitive information during transactions.

- compliance with PCI DSS: The Payment Card Industry Data security Standard (PCI DSS) sets rigorous security requirements for all companies that accept credit card payments. Choose a payment gateway that is fully compliant.

- Fraud Detection Tools: Look for gateways that offer robust fraud detection and prevention tools, including artificial intelligence-driven analytics and transaction monitoring.

Another critical aspect is the integration capabilities of the payment gateway. A seamless integration with your existing e-commerce platform not only streamlines the payment process but also enhances security by reducing the risk of data exposure. Here’s what to consider:

- API Support: Choose a gateway that provides easy-to-use APIs for developers, allowing for a secure and efficient integration.

- Customization Options: The ability to customize the payment interface can help maintain a consistent brand experience while ensuring that sensitive data is processed securely.

assess the customer support services offered by the payment gateway provider. In the event of a security incident or technical issue, having access to responsive support can be invaluable. Look for:

- 24/7 Support: Ensure that customer service is available around the clock to assist you promptly.

- Dedicated Account Managers: Having a point of contact can definitely help in navigating any security concerns quickly and effectively.

To provide a clearer view of your options, here’s a quick comparison of some top providers based on their security features:

| Payment Gateway | Encryption | PCI DSS Compliance | Fraud Tools |

|---|---|---|---|

| Provider A | TLS 1.3 | Yes | AI Monitoring |

| Provider B | TLS 1.2 | Yes | Transaction Scoring |

| Provider C | End-to-End Encryption | Yes | Real-time Alerts |

By prioritizing security in your decision-making process, you can choose a payment gateway that not only meets your business needs but also builds trust with your customers. A secure checkout experience can lead to higher conversion rates and customer loyalty, making it an essential aspect of your e-commerce strategy.

User experience Matters: Simplifying Checkout for Your Customers

In the fast-paced world of e-commerce,the importance of a seamless checkout experience cannot be overstated. Customers today demand quick,efficient,and secure payment options that don’t disrupt their shopping journey. A complicated checkout process can lead to cart abandonment, which hurts not just sales but also customer trust. By simplifying checkout, you enhance user experience and pave the way for increased conversions.

When evaluating different payment gateways for your business, consider features that streamline the checkout process. Look for providers that offer:

- One-click payments: This feature allows returning customers to make purchases with minimal friction, significantly reducing the time spent on checkout.

- Mobile optimization: With a growing number of users shopping on their mobile devices, ensure your payment gateway functions flawlessly on all screen sizes.

- Multiple payment options: Offering various payment methods—credit cards, digital wallets like PayPal and Apple Pay, and even cryptocurrency—can cater to diverse customer preferences.

- Security features: Customers want to know their information is safe. Look for gateways that offer PCI compliance and advanced encryption standards.

Another critical aspect to consider is the integration capabilities of your payment gateway. A solution that easily integrates with your existing e-commerce platform can save you time and resources. Many top providers offer plugins or APIs that seamlessly blend with popular platforms like WooCommerce or Shopify. This means you can implement changes quickly and without significant technical expertise.

To help you make an informed decision, we’ve compiled a comparison table highlighting key features of the top payment gateways for 2025:

| Provider | One-click Payments | Mobile Optimization | Fees |

|---|---|---|---|

| Stripe | ✔ | ✔ | 2.9% + 30¢ per transaction |

| PayPal | ✔ | ✔ | 2.9% + 30¢ per transaction |

| Square | ✖ | ✔ | 2.6% + 10¢ per transaction |

| Adyen | ✔ | ✔ | Varies based on volume |

investing in a user-friendly payment gateway is essential for optimizing your checkout process. By prioritizing user experience, you not only reduce friction but also enhance customer satisfaction and loyalty. customers are more likely to complete their purchase when they feel confident in the security and efficiency of your payment options.Remember, a smooth checkout experience can be the difference between a successful sale and a missed opportunity.

Integration Ease: Connecting with Your Existing Systems

When choosing a payment gateway, one of the most critical aspects to consider is how effortlessly it integrates with your existing systems. In today’s digital landscape, businesses rely on a multitude of tools and software to manage operations, from eCommerce platforms and CRM systems to accounting software. The right payment gateway should fit seamlessly into this ecosystem, minimizing disruptions and maximizing efficiency.

Key Features to Look For:

- API Compatibility: Ensure the payment gateway offers robust APIs that allow for easy integration with your current systems.

- Plugin Availability: look for gateways that provide plugins for popular eCommerce platforms like WooCommerce, Shopify, or Magento, reducing the need for extensive custom progress.

- Middleware Support: If your operations rely on middleware, confirm that the payment gateway can communicate effectively with these solutions to streamline data transfer.

- Customization Options: Customizable settings can definitely help tailor the payment process to fit your brand and operational needs.

Let’s take a closer look at how some of the leading payment gateway providers stack up against each other based on their integration capabilities:

| provider | API Integration | Plugin Support | Customization |

|---|---|---|---|

| stripe | excellent | Multiple Plugins | Highly Customizable |

| PayPal | good | Various Options | Moderate Customization |

| Square | Very Good | Limited Plugins | Good Customization |

| Braintree | Excellent | Multiple Plugins | Highly Customizable |

As you can see, the integration ease varies significantly among providers. Stripe and Braintree stand out for their robust API and extensive plugin support, making them excellent choices for businesses looking for flexibility and extensive customization. On the other hand, while PayPal offers decent integration options, its customization capabilities may not be sufficient for more complex needs.

Ultimately, the right payment gateway for your business will depend on how well it can harmonize with your existing systems, ensuring a seamless payment experience for both you and your customers.When evaluating your options, prioritize providers that not only meet your functional requirements but also facilitate easy integration into your current workflow.

Customer Support: Why It’s Critical for Your Business

In the fast-paced world of e-commerce and digital transactions, effective customer support is not just a luxury; it’s a necessity.When customers encounter issues with payment gateways, having immediate access to knowledgeable support can save a sale and enhance customer loyalty. Actually, 73% of consumers fall in love with a brand as of friendly customer service. This statistic alone highlights why investing in customer support should be a priority for any business.

imagine a scenario where a customer is ready to make a purchase but encounters an error during the payment process. Without responsive customer support, that potential sale coudl be lost forever. On the flip side, if customers receive prompt assistance, they are more likely to complete their transaction and return for future purchases. Here are several key reasons why strong customer support teams are essential:

- Enhanced Customer Experience: quick resolutions to issues create a smoother buying experience.

- Increased Trust: Reliable support fosters trust in your brand, making customers feel secure in their transactions.

- Word-of-Mouth Marketing: Happy customers share their experiences, which can draw more business.

- Competitive Advantage: Exceptional support can distinguish your business from competitors with less responsive service.

Moreover, customer support can provide valuable insights into your payment gateway’s performance.By tracking the types of inquiries and issues that arise, businesses can identify common pain points and address them proactively. This data can be invaluable in choosing the right payment gateway provider that aligns with customer needs. Here’s a brief overview of how various payment gateways stack up in terms of customer support:

| Payment Gateway | Support Channels | Response Time | Customer Satisfaction |

|---|---|---|---|

| Provider A | Email, live Chat, Phone | under 1 hour | 4.8/5 |

| Provider B | Email, Phone | 1-3 hours | 4.5/5 |

| Provider C | live Chat, Phone | Under 30 minutes | 4.9/5 |

the importance of customer support in the realm of payment gateways cannot be overstated. with reliable and responsive support, businesses can not only improve customer satisfaction but also drive sales and foster loyalty. As you explore options for payment gateway providers in 2025, consider how their support offerings align with your business needs. Remember, the right choice can elevate your customer experience and ultimately contribute to your business’s success.

Future Trends: What to Expect in Payment Technology

As we look ahead to 2025, the landscape of payment technology is poised for significant change driven by advancements in innovation and shifts in consumer behavior. Businesses are increasingly recognizing the importance of embracing these changes to create seamless transaction experiences. here are some key trends that are expected to shape the future of payment technology:

- Contactless Payments: The rise of NFC (near-field communication) technology is making contactless transactions more popular than ever. Consumers appreciate the speed and convenience of tapping their cards or smartphones to pay, and businesses are eager to accommodate this demand.

- Cryptocurrency Integration: With the growing acceptance of cryptocurrencies, payment gateways are starting to support digital currencies. This trend will provide businesses with an innovative way to reach tech-savvy customers and offer more diverse payment options.

- AI & Machine Learning: The use of artificial intelligence in payment processing is set to enhance security and fraud detection. Predictive analytics will allow providers to assess transaction risks in real-time, ensuring safer transactions for consumers.

- Subscription and Recurring Payments: The popularity of subscription models is prompting payment gateways to enhance their recurring billing functionalities. This will streamline operations for businesses that rely on subscriptions, making it easier to manage customer payments.

| Trend | Impact |

|---|---|

| Contactless Payments | Faster transactions and improved customer satisfaction |

| Cryptocurrency | Attracting a broader customer base with diverse payment options |

| AI & Machine Learning | Enhanced security and fraud prevention |

| Subscription Payments | Streamlined billing and improved cash flow management |

Additionally, the emphasis on mobile payment solutions continues to grow. With mobile wallets gaining traction, businesses must ensure their payment gateways are optimized for mobile use. This shift not only caters to consumer preferences but also enhances the overall shopping experience.

Lastly, regulatory changes will also play a crucial role in shaping payment technology.Compliance with new regulations will necessitate upgrades and adaptations in payment gateways, but these changes can ultimately lead to improved trust and security in digital transactions.Providers that prioritize compliance will stand out in a crowded market.

Final Recommendations: Choosing the Right Gateway for You

When navigating the crowded landscape of payment gateways, it’s crucial to align your choice with your business’s unique needs and goals. Each provider brings its own set of features, fees, and advantages that can significantly impact your bottom line. Here are a few key considerations to help you make an informed decision:

- Transaction Fees: Evaluate the fee structures of different gateways. Some may charge a flat rate, while others have variable rates based on transaction volume. A low initial fee might be enticing, but consider how it scales as your business grows.

- Payment Options: Look for gateways that support various payment methods. From credit and debit cards to digital wallets and cryptocurrencies, the more options you provide, the easier you make it for customers to complete their purchases.

- Security Features: With cyber threats on the rise, security should be a top priority. Ensure the gateway you choose offers robust fraud protection, PCI compliance, and encryption protocols to safeguard sensitive customer data.

It’s also essential to consider the level of customer support offered. Reliable support can make a world of difference, especially during critical times or technical glitches. Opt for a provider known for prompt and helpful customer service, with various communication channels available.

Another factor to weigh is the ease of integration with your existing systems.A payment gateway that seamlessly connects with your eCommerce platform or accounting software can save you time and headaches down the line. Check for plugins or APIs that support smooth integration.

| Payment Gateway | Transaction Fee | Support | Integration |

|---|---|---|---|

| Gateway A | 2.9% + $0.30 | 24/7 Chat & Phone | Easy – WooCommerce, Shopify |

| Gateway B | 2.5% + $0.20 | Email Support | Moderate – Custom API |

| Gateway C | 3.0% + $0.35 | Phone Support Only | Easy – Pre-built Plugins |

don’t forget to read user reviews and testimonials.Real-world feedback can provide invaluable insights into how well a payment gateway performs under pressure and how satisfied other businesses have been with their services.

Frequently Asked Questions (FAQ)

Q&A for “Payment Gateway Comparison: Top Providers Analyzed for 2025”

Q1: What is a payment gateway, and why is it vital for businesses?

A1: A payment gateway is a technology that enables businesses to accept online payments securely. It acts as the intermediary between your customer’s payment method and your business account. In today’s digital age, having a reliable payment gateway is crucial. It not only ensures secure transactions but also enhances customer trust,making it easier for businesses to convert sales.

Q2: What should businesses look for when choosing a payment gateway?

A2: When selecting a payment gateway, businesses should consider several key factors: transaction fees, types of payment methods supported, security features (like PCI compliance), ease of integration with existing systems, and customer support. Additionally, look for features like mobile payment options and multi-currency support if you’re targeting international customers. Choosing the right gateway can significantly impact your sales process and customer satisfaction.

Q3: Who are the top payment gateway providers for 2025?

A3: Some of the leading payment gateway providers for 2025 include PayPal, Stripe, Square, Authorize.Net, and Adyen. Each of these providers has unique features and benefits that cater to different business needs. For instance, Stripe is well-known for its developer-friendly tools, while Square shines for its all-in-one solution ideal for small businesses.

Q4: How do transaction fees vary among these providers?

A4: Transaction fees can vary widely depending on the provider and the volume of transactions you handle. For example, paypal typically charges around 2.9% + $0.30 per transaction,while Stripe has similar rates but may offer lower fees for higher volume businesses.It’s crucial to analyze your expected transaction volume and structure to find the most cost-effective option for your specific situation.

Q5: What are some common security features offered by these payment gateways?

A5: Most top payment gateways prioritize security and offer features such as SSL encryption, tokenization, and fraud detection tools. Additionally, compliance with PCI DSS (Payment Card Industry Data Security Standard) is a must. Some providers also offer 3D Secure authentication, which adds an extra layer of protection against fraudulent transactions. Ensuring your payment gateway has robust security measures is non-negotiable for protecting both your business and your customers.

Q6: How easy is it to integrate these gateways with e-commerce platforms?

A6: Integration ease varies by provider, but many top gateways offer plugins or APIs that simplify the process. As a notable example, Stripe and PayPal have seamless integrations with popular e-commerce platforms like Shopify, WooCommerce, and Magento. If you’re not a tech whiz, it’s worth looking for providers that offer dedicated support or documentation to help you through the setup.

Q7: What should businesses keep in mind about customer support when choosing a payment gateway?

A7: Customer support is vital, especially if something goes wrong during transactions.Look for payment gateways that offer 24/7 support through multiple channels, such as phone, live chat, and email. A responsive support team can help you resolve issues quickly, minimizing downtime and ensuring a smooth experience for your customers.

Q8: Can you give us a sneak peek into the best payment gateway for startups in 2025?

A8: For startups, Stripe is often highlighted as a top choice in 2025 due to its scalability, user-friendly interface, and robust developer resources. It allows you to start small and scale up as your business grows, making it a perfect fit for emerging businesses looking to adapt and innovate. Plus, with its transparent pricing model, you won’t be hit with hidden fees as you expand.

Q9: Why should readers care about comparing payment gateways now?

A9: The landscape of online payments is constantly evolving,with new technologies and regulations emerging all the time. By comparing payment gateways now,you can position your business for success in 2025 and beyond. Choosing the right gateway can streamline your payment process, improve customer experience, and ultimately, boost your bottom line.It’s an investment in your future that you can’t afford to overlook!

Q10: Where can readers find more detailed comparisons of these payment gateways?

A10: Readers can dive deeper into our full article, “Payment gateway Comparison: Top Providers Analyzed for 2025.” We dissect each provider’s features, pricing, and user experiences to help you make an informed decision. Plus, we provide a handy comparison chart to visualize your options quickly! Don’t miss out on the chance to equip your business with the best tools for success.

To Conclude

As we wrap up our deep dive into the world of payment gateways for 2025, it’s clear that choosing the right provider is more than just a business decision; it’s a game changer for your operations and customer experience. With so many options on the table, we hope this comparison has illuminated the unique strengths of each provider, helping you find that perfect match for your business needs.

remember, the right payment gateway can streamline your processes, enhance security, and ultimately boost your bottom line. As you weigh your options, consider not just the transaction fees, but the overall value and support each provider brings to the table. After all, a seamless payment experience can lead to happier customers and increased loyalty.

So, whether you’re a startup looking to make your mark or an established business aiming to optimize your transactions, take the time to explore these top providers further. The right choice is out there,waiting to propel your business into the future.

Thanks for joining us on this journey through the payment gateway landscape! We’re excited to see how you put this knowledge to use. Happy evaluating, and here’s to your success in 2025 and beyond!