Introduction: Unveiling the Secrets of Financially Triumphant Small Business Owners

So, you’ve taken the plunge into the world of small business ownership—congratulations! It’s an exhilarating journey filled with opportunities and challenges. But let’s be real: the road to financial success can sometimes feel like navigating a maze blindfolded. Have you ever wondered what separates the flourishing entrepreneurs from those who struggle to keep their heads above water? Well, you’re in luck! In this article, we’ll pull back the curtain on the secrets of financially successful small business owners. From savvy budgeting strategies to effective marketing techniques, we’ll share actionable insights that can transform your business dreams into reality. Ready to unlock the secrets? Let’s dive in!

Unlocking the Mindset of Financially Savvy Entrepreneurs

Financially savvy entrepreneurs possess a unique mindset that sets them apart from the crowd. This mindset is characterized by a blend of resilience, strategic thinking, and a proactive approach to managing finances. They view challenges as opportunities rather than obstacles, allowing them to pivot and adapt in an ever-changing business landscape. By embracing this mentality, they not only secure their current success but also lay the groundwork for future growth.

One key element of this mindset is the ability to set clear financial goals. Instead of merely focusing on revenue, they define specific, measurable, achievable, relevant, and time-bound (SMART) goals. These goals provide a roadmap for their financial journey, guiding decisions and helping to prioritize investments. A few examples of effective financial goals include:

- Increasing profit margins by a certain percentage over the next year

- Reducing operational costs within the next six months

- Expanding the customer base by 20% in the upcoming quarter

Moreover, financially savvy entrepreneurs understand the importance of cash flow management. They recognize that having cash on hand is crucial for seizing opportunities and weathering downturns. This means keeping a close eye on inflows and outflows, budgeting wisely, and regularly reviewing financial statements. A simple cash flow table can be an effective tool for monitoring financial health:

| Month | Cash Inflow | Cash Outflow | Net Cash Flow |

|---|---|---|---|

| January | $10,000 | $7,500 | $2,500 |

| February | $12,000 | $8,000 | $4,000 |

| March | $8,000 | $5,500 | $2,500 |

investing in knowlege and continuous learning is a hallmark of financially successful entrepreneurs. They actively seek out resources, whether through books, online courses, or networking with other business owners, to enhance their financial acumen. This commitment to learning equips them to make informed decisions, foresee potential pitfalls, and sieze opportunities that others might overlook. By nurturing their expertise, they position themselves for lasting success in the competitive business surroundings.

mastering the Art of Budgeting for Small Business Success

To thrive in the competitive landscape of small business, mastering budgeting isn’t just an option; it’s a necessity. A well-structured budget acts as a roadmap, guiding business owners through the financial terrain with clarity and confidence. Here are some key strategies that financially successful small business owners employ to create effective budgets:

- Prioritize Essential expenses: identify fixed costs, such as rent and utilities, and ensure they are covered first. This creates a solid foundation on which to build your budget.

- Forecast Income Realistically: Analyze previous sales data and market trends to predict future income. This helps in setting attainable financial goals.

- Track Spending Diligently: Regularly monitor actual expenditures against your budget. This practice allows you to identify areas where you might be overspending and adjust accordingly.

Creating a budget is not a one-time task; it requires ongoing attention and adjustment. Successful entrepreneurs frequently enough set aside time each month to review their financial status. During these reviews, they compare projected income and expenses against actual figures, enabling them to refine their budgeting process.

| Budget Component | Percentage of Budget |

|---|---|

| Fixed Costs | 30% |

| Variable Expenses | 40% |

| Savings & Investments | 20% |

| Marketing | 10% |

Another trait of financially savvy business owners is their willingness to leverage technology. Utilizing budgeting tools and financial software can considerably streamline the budgeting process. Many applications offer features such as expense tracking, forecasting, and real-time updates, simplifying the complexity of financial management.

Lastly, don’t underestimate the power of setting aside a contingency fund. Unforeseen expenses can derail even the best-laid plans, so having a cushion to fall back on can save your business from potential setbacks. by integrating these practices into your budgeting strategy, you’re not just managing your finances—you’re paving the way for sustainable growth and long-term success.

Building a Solid Cash flow Foundation: Tips and Tricks

Establishing a robust cash flow foundation is crucial for any small business owner looking to thrive in a competitive landscape.It’s not just about making sales; it’s about managing those funds effectively to ensure sustainability and growth. Here are some practical strategies to help you build a solid cash flow foundation.

- Maintain a Cash Reserve: Set aside a portion of your profits into a cash reserve. This buffer can definitely help cover unexpected expenses and ensure that you can continue operations during lean periods.

- Invoice Promptly: Send out invoices as soon as a service is rendered or a product is delivered. The sooner you request payment, the quicker it will flow into your accounts.

- Adopt Flexible Payment Terms: Consider offering various payment options (credit cards, PayPal, etc.) and incentivizing early payments. This can accelerate cash inflow and improve customer satisfaction.

- Monitor Cash Flow Regularly: Use cash flow monitoring tools or software to keep an eye on inflows and outflows. Regular assessments allow you to identify potential issues before they escalate.

Additionally, understanding your business cycle can play a pivotal role in cash flow management. Recognize the patterns in your sales and expenses and plan accordingly. For instance, if you generally see a dip in sales during a specific season, prepare in advance by cutting back on expenses or boosting marketing efforts during peak times.

Lastly, consider the following table that highlights key practices that can enhance your cash flow:

| Practice | Description |

|---|---|

| Budgeting | Regularly create and update your budget to keep track of your financial health. |

| Supplier Relationships | Negotiate better terms with suppliers to extend payment periods without penalties. |

| Customer Management | Build strong relationships to encourage repeat business and timely payments. |

By implementing these strategies and staying proactive about your finances, you can establish a strong cash flow foundation that supports your business goals and paves the way for long-term success. Remember, cash flow management is an ongoing process that requires attention and adaptability.

Investing Wisely: Where to Put Your Money for maximum Returns

When it comes to growing your wealth as a small business owner, making informed investment choices is crucial. Rather of simply letting your money sit idle, consider allocating it into areas that promise high returns. Here are some avenues worth exploring:

- Stocks: Investing in a diversified portfolio of stocks can yield notable returns over time. Focus on companies with strong fundamentals and growth potential.

- Real Estate: Properties can appreciate significantly, and investing in rental properties can provide a steady income stream.

- Mutual Funds and ETFs: These funds allow you to invest in a diversified array of assets without having to pick individual stocks.

- Peer-to-Peer lending: Platforms that facilitate loans between individuals can offer attractive interest rates.

- Retirement Accounts: Maximize contributions to IRAs or 401(k)s to benefit from tax advantages while saving for the future.

Another option that small business owners should consider is investing in themselves through education and skills advancement. Knowledge is a powerful asset. Take courses or attend seminars to enhance your skills in financial management, marketing, or technology. This personal investment not only boosts your business but also increases your earning potential.

| Investment Type | Average Annual Return | Risk Level |

|---|---|---|

| Stocks | 7-10% | High |

| Real Estate | 8-12% | Moderate |

| Mutual Funds | 5-8% | Moderate |

| Peer-to-peer Lending | 5-12% | Moderate to High |

| retirement Accounts | 6-8% | Low to Moderate |

Lastly,don’t overlook the potential of investing in technology for your business. Upgrading your systems or incorporating new software can lead to increased efficiency, reduced costs, and ultimately higher profits.Whether it’s adopting e-commerce solutions or utilizing data analytics, investing in technology often pays off in the long run.

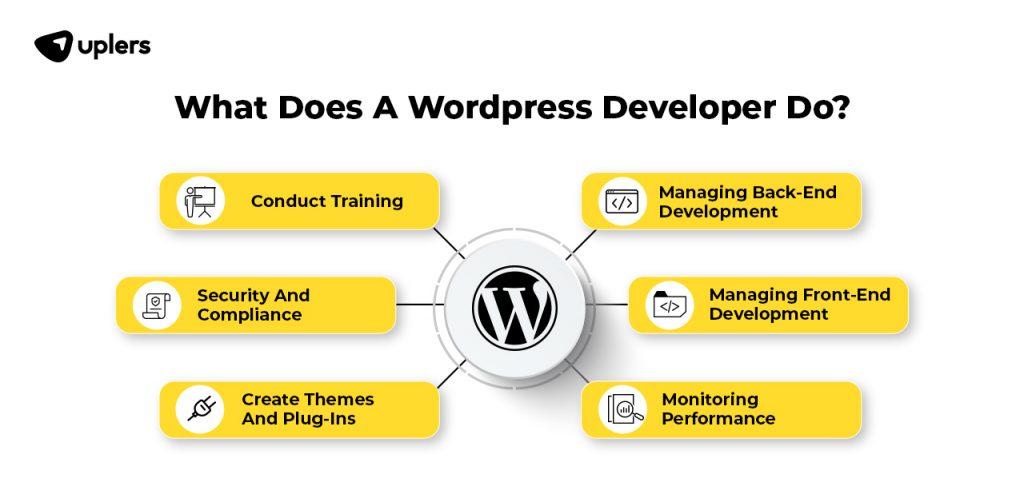

Leveraging Technology to Streamline Financial Management

In today’s fast-paced business world, embracing technology is crucial for small business owners looking to enhance their financial management processes. The right tools can transform a tedious and error-prone task into a streamlined operation that not only saves time but also improves accuracy. By integrating technology into your financial management, you can focus on what truly matters: growing your business.

Consider the use of cloud-based accounting software.Platforms such as QuickBooks, Xero, or FreshBooks allow you to manage your finances from anywhere, anytime. This flexibility is especially useful for small business owners who are always on the go. With these tools, you can easily track income and expenses, manage invoices, and generate financial reports with just a few clicks.Additionally, these systems frequently enough come with automated features that minimize manual data entry, reducing the risk of human error.

Another game-changing technology is expense tracking apps. These applications can help you monitor your spending in real-time, categorize expenses, and even upload receipts directly from your smartphone. By keeping a close eye on your expenditures, you can make informed decisions that contribute to your business’s bottom line. Some popular options include Expensify, Receipt bank, and Shoeboxed, each offering unique features to suit different business needs.

| App Name | Key Features | Best For |

|---|---|---|

| Expensify | Automated receipt scanning, expense reporting | Frequent travelers |

| Receipt Bank | Cloud storage, integration with accounting software | Simplifying bookkeeping |

| Shoeboxed | Receipt organization, mileage tracking | On-the-go professionals |

lastly, leveraging financial forecasting tools can offer invaluable insights into your business’s future. By analyzing ancient data and market trends, these tools help you predict cash flow, budget effectively, and identify potential financial challenges before they arise. Tools like Float or LivePlan enable you to visualize your financial trajectory,ensuring you’re always a step ahead in your planning.

The Power of Networking: Building relationships that Pay Off

In today’s competitive landscape, the adage “it’s not what you know, but who you know” holds more truth than ever for small business owners. Establishing a robust network can open doors to new opportunities, partnerships, and resources that might otherwise remain out of reach. The connections you cultivate today can yield notable returns down the line, influencing everything from client acquisition to strategic growth.

Building relationships requires intentionality and effort. Start by identifying key players in your industry and related fields. Attend networking events, workshops, and conferences to meet these individuals face-to-face. Consider the following strategies:

- be Genuine: Authenticity goes a long way. People are more likely to remember and connect with you if they sense your sincerity.

- Follow Up: After meeting someone, send a quick note to express your thankfulness for the conversation and suggest staying in touch.

- Offer Value: Networking is a two-way street. Be prepared to share your skills or connect others within your network to show you’re invested in their success as well.

Moreover,leverage social media platforms like LinkedIn to enhance your networking efforts. Online platforms can significantly amplify your reach,allowing you to engage with industry leaders and participate in discussions related to your field. Regularly share insights, articles, and successes to keep your profile visible and relevant.

To illustrate the impact of networking, consider the following table showcasing successful collaborations formed through strategic connections:

| Business Owner | Connection Type | Outcome |

|---|---|---|

| Jane Smith | mentor | Secured funding for expansion |

| John Doe | Partnership | doubled client base within a year |

| Sara Lee | Industry Event | Formed collaboration with a major supplier |

In essence, viewing networking as an investment in your business’s future can transform how you approach relationship-building. The more authentic connections you forge, the more likely you are to create a supportive community that fosters growth and success.

Understanding Your Market: Using Data to Drive Financial Decisions

In today’s competitive landscape, understanding your market is not just an option; it’s a necessity for small business owners looking to thrive financially. Harnessing the power of data allows you to make informed decisions that can steer your business towards sustainable growth. Here’s how you can leverage data effectively:

- Analyze Customer Behavior: By tracking purchasing patterns and preferences,you can tailor your offerings to meet customer needs. Use tools like Google Analytics or CRM software to gather insights.

- Monitor Industry Trends: Stay updated with the latest trends in your industry. Subscribing to industry reports and using social media analytics can provide you with valuable information on what your competitors are up to.

- Forecast Financial Performance: Historical data can help you predict future sales and expenses. Creating a financial model based on past performance allows for better budgeting and financial planning.

Data can also guide pricing strategies, ensuring you remain competitive while maximizing profit margins. Customer feedback, combined with market analysis, can reveal how much your target audience is willing to pay. This can lead to price adjustments that optimize revenue without sacrificing customer satisfaction.

Consider implementing a dashboard that visualizes your key metrics. Tools like Tableau or Power BI can transform complex data sets into easy-to-understand charts and graphs. This not only helps in monitoring performance but also assists in quick decision-making.Below is a sample layout you might consider for your dashboard:

| Metric | Current Value | Target Value |

|---|---|---|

| Monthly Sales | $15,000 | $20,000 |

| Customer acquisition Cost | $50 | $40 |

| Net Profit Margin | 10% | 15% |

Lastly, do not overlook the power of customer segmentation. By dividing your customer base into distinct groups based on demographics, behaviors, or preferences, you can create targeted marketing campaigns that resonate more effectively. This approach not only enhances customer loyalty but also increases your return on investment.

Creating a Sustainable Business Model for Long-Term Profitability

In today’s competitive landscape, small businesses must cultivate a model that not only drives immediate profits but also ensures longevity. This involves integrating sustainability into the core of your operations. By prioritizing environmentally and socially responsible practices, you not only appeal to a growing conscious consumer base but also can enhance your operational efficiency and reduce costs.

To achieve a sustainable business model, consider these key strategies:

- Understand Your Impact: Conduct a thorough assessment of your business processes to identify areas where you can reduce waste and minimize your carbon footprint.

- Invest in Green Technologies: Embrace technologies that enhance energy efficiency, such as renewable energy sources or smart equipment that lowers consumption.

- Build Stronger Community Ties: Engage with local suppliers and customers to create a community-focused network, which can enhance loyalty and local support.

- Offer Sustainable Products: Shift towards offering products or services that are sustainable, thereby appealing to eco-conscious consumers.

Creating a sustainable business model is not just about being green; it’s about building a resilient business that can adapt and thrive. Here’s a simple table to illustrate how sustainability can enhance your profit margins:

| Strategy | Potential Savings | Long-Term Benefits |

|---|---|---|

| energy Efficiency Upgrades | 20-30% reduction in utility costs | Longer equipment lifespan |

| Waste Reduction Programs | 10-15% savings on disposal costs | Enhanced community reputation |

| Eco-Amiable products | Higher price margins | Increased market share |

engaging employees in sustainability initiatives can also create a culture of innovation and accountability within your organization. When your team is aligned with your vision for a sustainable future, they are more likely to contribute ideas and solutions that not only enhance your business model but also improve employee satisfaction.

Ultimately, the path to long-term profitability lies in a commitment to sustainability that resonates with both your customers and your workforce.By weaving these practices into the fabric of your business, you’re not only securing your financial future but also contributing to a healthier planet.

Learning from Mistakes: How to Turn Financial Setbacks into Success Stories

Financial setbacks can feel daunting, but they frequently enough hold the key to future success. Small business owners who encounter these challenges can choose to view them as learning opportunities rather than insurmountable obstacles. Here are some strategies to transform those missteps into stepping stones:

- Reflect and Analyze: Take the time to assess what went wrong. Was it a budgeting mistake? A miscalculation in market demand? understanding the root cause will help you avoid similar pitfalls in the future.

- Seek Feedback: Don’t hesitate to discuss your experiences with mentors or other business owners. Their insights can provide valuable perspectives you may have overlooked.

- Adjust Your Strategy: Use the lessons learned to pivot your business approach. This might mean revisiting your pricing model, marketing tactics, or even your product offerings.

One effective way to visualize your recovery plan is by creating a table that lists your challenges alongside potential solutions. Here’s a simple example of how to structure this:

| Challenge | Solution |

|---|---|

| declining Sales | Conduct market research to identify new trends and adapt offerings. |

| Cash Flow Issues | Implement stricter invoicing and payment policies to ensure timely payments. |

| High Operating costs | Explore cost-cutting measures, such as renegotiating supplier contracts. |

Additionally, consider tracking your progress over time. Set specific, measurable goals that will help you gauge advancement. Celebrate small victories along the way,as these will reinforce your confidence and motivate you to push forward.

remember that resilience is a hallmark of successful entrepreneurs. Embracing your mistakes and learning from them can build a solid foundation for a more robust and resilient business. By fostering a mindset of continuous improvement, you’re not just recovering from setbacks but actively paving the way for future triumphs.

The Importance of Continuous Education in Financial Literacy

In today’s rapidly changing economic landscape, staying informed is not just an option but a necessity for small business owners aspiring for financial success. Continuous education in financial literacy empowers entrepreneurs to make informed decisions that can significantly impact their bottom line.The knowledge gained through ongoing learning allows business owners to navigate complex financial situations, ensuring they are not just reactive but proactive in their strategies.

Consider the following benefits of enhancing financial literacy:

- Improved Decision-Making: With a solid grasp of financial principles, business owners can analyze their options more clearly and choose the most beneficial paths for growth.

- Increased Profitability: Understanding financial metrics can help identify areas where costs can be cut or revenue can be increased, directly influencing profit margins.

- Risk Management: A well-rounded education in finance equips owners with the tools to assess risks and implement strategies to mitigate potential financial pitfalls.

Moreover, participating in workshops, seminars, and online courses can introduce business owners to the latest trends in finance and technology. As a notable example, learning how to utilize financial software can streamline operations and provide real-time data, leading to timely and informed decisions. The following table highlights a few key areas of financial literacy that can be particularly beneficial:

| Financial Literacy Area | Benefits |

|---|---|

| Cash Flow Management | Ensures that there is enough cash available to meet obligations and seize opportunities. |

| Budgeting | Helps in planning expenditures and saving towards future goals. |

| Investment Knowledge | Guides owners in making wise investment choices that grow their business. |

Ultimately, the commitment to lifelong learning in financial matters fosters a culture of adaptability and resilience. As markets fluctuate and new challenges arise,small business owners who prioritize education can pivot effectively,ensuring their enterprises not only survive but thrive.Investing time and resources in financial literacy is an investment in the future of the business itself.

Frequently asked Questions (FAQ)

Q&A: Secrets of Financially Successful Small Business Owners

Q1: What do you think is the biggest secret behind the success of financially thriving small business owners?

A1: You might be surprised, but it all boils down to discipline and planning. Successful small business owners frequently enough take the time to set clear financial goals and create actionable plans to achieve them. They aren’t just winging it! They have budgets, forecasts, and strategies in place that help them stay on track.

Q2: That sounds critically important! But how do they stay disciplined? Is it about willpower?

A2: Great question! While willpower plays a role, it’s more about creating habits. Successful owners often set a routine that includes regular financial reviews, market analysis, and adapting their strategies as needed.They know that keeping their financial health in check is non-negotiable,and they make it a priority.

Q3: What financial tools or resources do these successful owners use?

A3: Many financially savvy business owners leverage technology to their advantage. They use accounting software, budgeting tools, and analytics platforms to keep track of their income and expenses. Tools like QuickBooks or FreshBooks can simplify everything from invoicing to reporting, making it easier to make informed decisions.

Q4: Do these business owners seek help from financial advisors or mentors?

A4: Absolutely! Many successful small business owners understand the value of guidance. They frequently consult with financial advisors or join peer groups to gain insights and different perspectives. It’s all about surrounding yourself with knowledge and support to help navigate the complexities of running a business.

Q5: how do they handle setbacks or financial difficulties?

A5: Resilience is key! Instead of panicking,successful owners view setbacks as learning opportunities. They analyze what went wrong, adjust their strategies accordingly, and remain focused on their long-term goals. This mindset not only helps them overcome challenges but also positions them for future success.

Q6: Can you share any common traits among these successful owners?

A6: Of course! Besides discipline and resilience, successful small business owners are often adaptable and proactive. They stay informed about market trends and are open to innovation. They’re not afraid to pivot their strategies when necessary,which keeps their businesses relevant and competitive.

Q7: Is it too late for someone who is struggling to implement these secrets?

A7: Not at all! It’s never too late to make a change. The first step is acknowledging the need for improvement. Once you commit to applying these principles — like setting clear goals, seeking guidance, and using the right tools — you can start turning things around. Remember, every successful business was once a work in progress!

Q8: What’s the most important takeaway for aspiring small business owners?

A8: The most crucial takeaway is that success doesn’t happen overnight. It requires dedication, planning, and a willingness to learn and adapt. By implementing these secrets and consistently working towards your goals, you can pave the way for a financially successful future. So, start today — your business dreams are within reach!

Concluding Remarks

As we wrap up our exploration of the secrets behind financially successful small business owners, it’s clear that thriving in today’s competitive landscape requires more than just a great idea. It’s about mindset, strategy, and a willingness to adapt and learn. Whether you’re just starting out or looking to revitalize your existing business, remember that success doesn’t come overnight. It’s built on dedication, smart financial management, and a community of support.

so, why not take that first step today? Evaluate your current strategies, set clear financial goals, and don’t hesitate to seek out mentorship or resources that can guide you along the way.The journey may be challenging, but with the right tools and knowledge, you can position yourself for success and watch your business flourish.

now, go forth with confidence and curiosity! Embrace the secrets we’ve discussed, and you’ll find that financial success is not just a dream—it’s a destination within your reach. Happy entrepreneuring!