Sure! Here’s a conversational and persuasive introduction for your article:

When it comes to running an online business, understanding the ins and outs of payment systems can feel like navigating a maze.You’ve probably heard terms like “payment gateway” and “payment processor” tossed around, but do you really know what they mean and how they differ? If you’re looking to streamline your transactions and boost your bottom line, grasping these distinctions is absolutely essential. In this article,we’ll break down the differences between payment gateways and payment processors in a way that’s easy to understand,so you can make informed decisions that benefit your business. Whether you’re a seasoned entrepreneur or just starting out, knowing the roles these two components play will help you choose the right solutions for your payment needs. Ready to dive in? Let’s unravel the mystery together!

—

Feel free to modify any part if you’d like to add your own flair!

understanding the Basics of Payment Gateways and Payment Processors

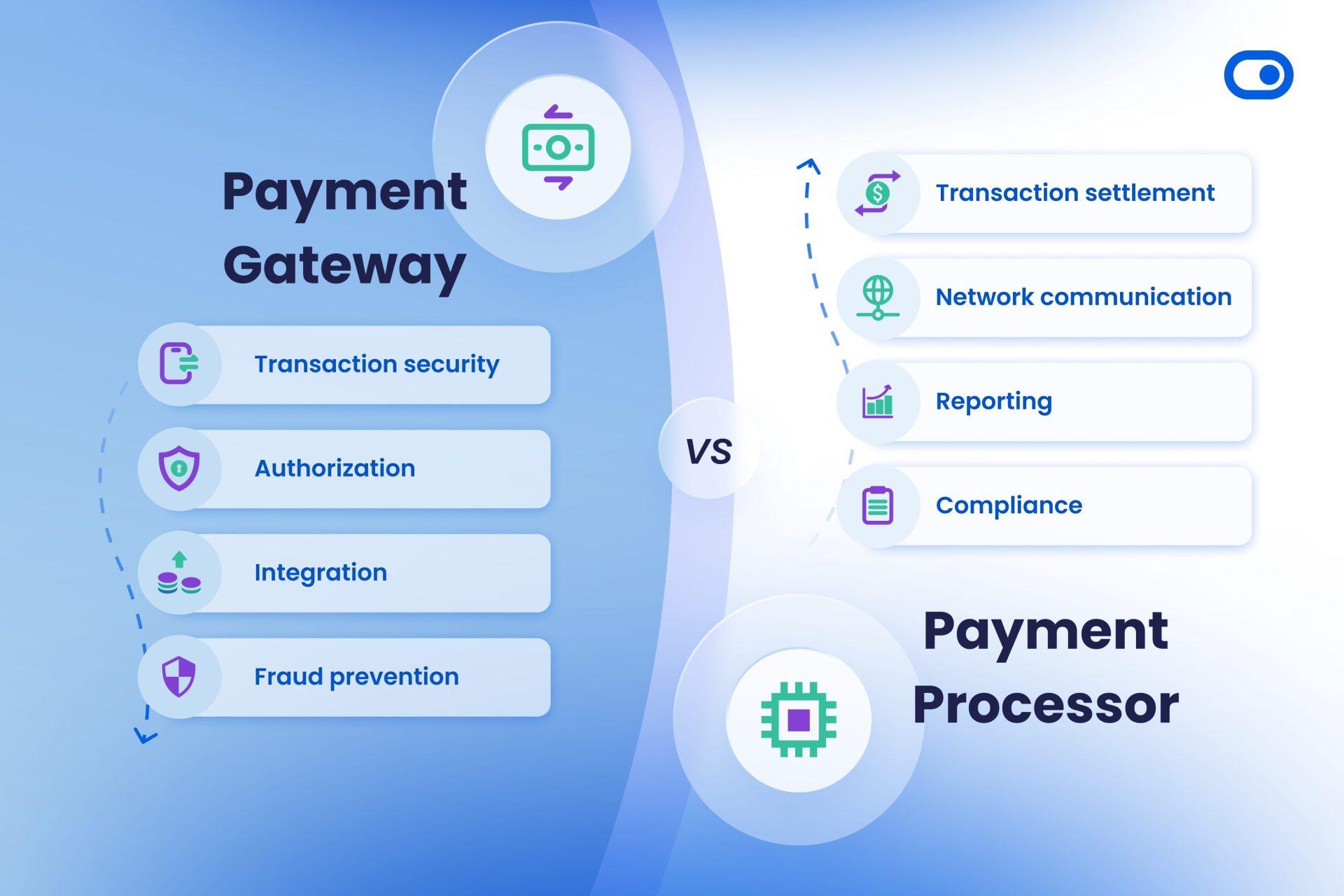

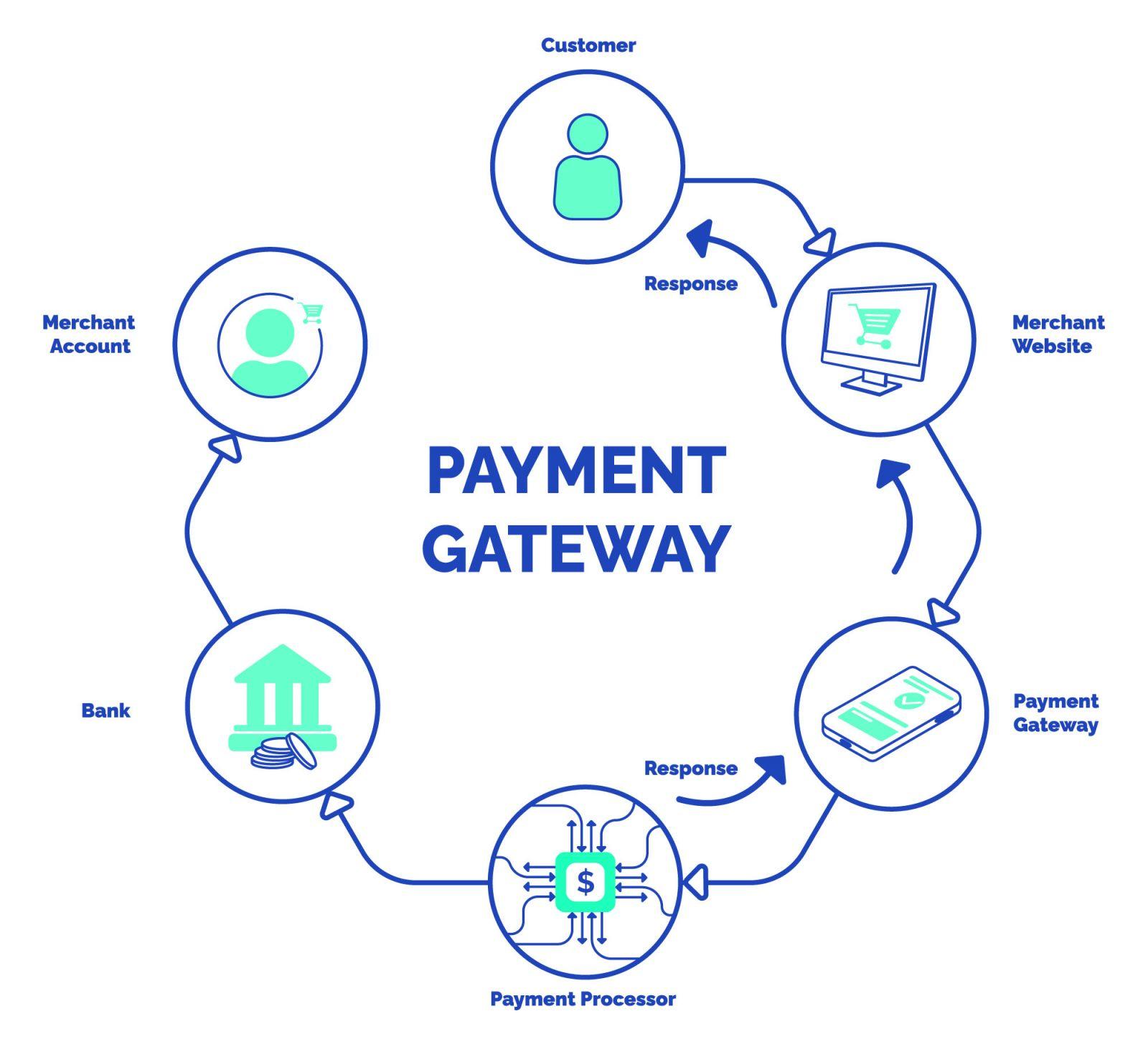

When navigating the world of online transactions, it’s essential to understand two key components: payment gateways and payment processors. While often used interchangeably, they serve distinct functions in the digital payment ecosystem. A payment gateway acts as the intermediary that securely transmits transaction data between the customer and the merchant, while a payment processor is responsible for handling the actual transaction, ensuring the funds are transferred from the customer’s account to the merchant’s account.

Here are some fundamental differences to consider:

- Functionality: The payment gateway is primarily focused on capturing and encrypting the payment details. In contrast, the payment processor manages the transaction itself, including the authorization and settlement of funds.

- Security: payment gateways employ encryption and tokenization technologies to safeguard sensitive data during transmission, whereas payment processors ensure compliance with regulations like PCI DSS to protect financial information during processing.

- Integration: A payment gateway must be integrated into the e-commerce platform, providing a seamless checkout experience, while payment processors work behind the scenes to facilitate the actual movement of money.

the interaction between these two components is crucial for any online business. When a customer makes a purchase, the payment gateway captures the data and sends it to the payment processor for verification. if the transaction is approved,the processor facilitates the transfer of funds,completing the sale. This seamless connection ensures that merchants can offer a smooth and secure checkout process, which is vital for customer satisfaction and retention.

To clarify these roles further, consider the following table that outlines the primary characteristics of each:

| Feature | Payment Gateway | payment Processor |

|---|---|---|

| Data Transmission | Encrypts customer data | Handles transaction processing |

| Primary Role | Acts as a bridge between customer and merchant | Authorizes and transfers funds |

| Security Compliance | Ensures secure data entry | Maintains financial data security standards |

understanding these differences helps businesses choose the right solutions for their needs.A well-chosen payment gateway and processor can enhance customer experience, increase conversion rates, and ultimately drive sales growth. By grasping the unique roles these services play, merchants can better navigate their options in the evolving landscape of digital payments.

Key Features That Set Payment Gateways Apart from Payment Processors

When it comes to online transactions, understanding the distinctions between payment gateways and payment processors is crucial for businesses looking to optimize their payment experiences. Each component plays a unique role, but certain features set them apart in terms of functionality and user experience.

- Integration Capabilities: Payment gateways frequently enough provide seamless integrations with various e-commerce platforms,making it easier for businesses to implement payment solutions without extensive technical knowledge. In contrast, payment processors may require more complex setups or custom coding.

- User Experience: A payment gateway is designed with the end-user in mind. It facilitates a streamlined checkout process, often offering customizable interfaces that reflect the brand’s identity. payment processors, however, operate more behind the scenes, focusing primarily on the transaction’s back-end.

- Security Features: Security is paramount in digital transactions. Payment gateways typically employ advanced encryption and fraud detection measures to protect sensitive customer data.Payment processors also prioritize security but may not offer the same level of customer-facing features that reassure users during the checkout process.

- Recurring Payments: Many payment gateways come equipped with features that support subscription models and recurring payments, making them ideal for businesses that rely on consistent revenue streams. Payment processors may not always offer this functionality as part of their core services.

Along with these features, payment gateways often provide robust analytics and reporting tools that allow businesses to track transaction trends and customer behavior. This data can be invaluable for optimizing marketing strategies and improving conversion rates. Payment processors, while offering basic transaction data, may lack the extensive analytical capabilities that can drive business growth.

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Integration | Seamless with e-commerce platforms | Perhaps complex |

| User Experience | Customizable checkout interfaces | Back-end focus |

| Security | Advanced encryption and fraud detection | Security-focused, less customer-facing |

| Analytics | Robust reporting tools | Basic transaction data |

Ultimately, the choice between a payment gateway and a payment processor depends on a business’s specific needs and goals. Understanding these key features can help entrepreneurs make informed decisions that enhance their customers’ payment experiences while ensuring secure and efficient transactions.

How Payment Gateways and Processors Work Together in Transactions

Understanding the synergy between payment gateways and processors is crucial for businesses looking to streamline their transactions. While they each play distinct roles, their collaboration ensures that online transactions are secure, efficient, and user-friendly. let’s dive deeper into how these two components work together to facilitate seamless financial exchanges.

At the core of every online transaction, the payment gateway acts as the digital equivalent of a point-of-sale terminal.It captures and encrypts the customer’s payment information when they make a purchase. This encrypted data is then securely transmitted to the payment processor, which handles the verification and approval of the transaction. Without the payment gateway, the process would lack the necessary security measures to protect sensitive information, leaving both businesses and customers vulnerable.

Once the payment gateway sends the payment details to the payment processor, the processor communicates with the customer’s issuing bank. This step involves a series of checks to ensure that the funds are available and that the transaction is legitimate. Here’s how the flow typically works:

- The customer enters their payment information on the checkout page.

- The payment gateway encrypts and transmits this data to the payment processor.

- The processor contacts the issuing bank to verify the transaction.

- The bank approves or declines the transaction and sends the response back through the processor.

- The processor relays the result back to the payment gateway,which informs the customer.

This collaboration not onyl enhances security but also speeds up the transaction process, making it seamless for users. moreover, each of these entities offers unique features and capabilities. To clarify their differences, consider the following table:

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Function | Encrypts and transmits payment information | Handles transaction authorization and settlement |

| Security | Ensures secure transactions with encryption | Manages risk and fraud detection |

| User Interaction | Visible to customers at checkout | Typically behind the scenes |

| Fees | May charge a flat fee or a percentage per transaction | Usually charges a per-transaction fee |

By ensuring that both the payment gateway and processor function effectively together, businesses can provide a frictionless experience for their customers. This not only builds trust but also encourages repeat business,which is essential for growth in the competitive online marketplace. Investing in a robust payment infrastructure that highlights the strengths of both can drastically improve transaction efficiency and customer satisfaction.

The Role of Security in Payment Gateways and Processors

security is a paramount concern in the world of digital transactions, influencing both payment gateways and processors significantly. The primary function of these systems is to facilitate transactions seamlessly; though, without robust security measures, the integrity of these financial exchanges would be compromised. Encryption, tokenization, and compliance with standards such as PCI DSS (Payment Card industry Data Security Standard) play crucial roles in protecting sensitive information during transactions.

When discussing security, it is essential to understand the differences in responsibilities between payment gateways and processors. While gateways act as the front line, capturing payment details and routing them to the processor, processors handle the actual transaction processing with banks and financial institutions. both need to work in tandem, but the former requires strong measures to ensure that customer data is transmitted securely. As an example:

- encryption: Prevents attackers from intercepting sensitive data during transmission.

- Tokenization: Replaces sensitive card information with a unique identifier, minimizing the risk of fraud.

- SSL Certificates: Establish a secure connection between the customer and the gateway, ensuring data is protected.

Moreover, compliance with industry standards cannot be overstated.Payment processors must ensure they adhere to PCI DSS requirements to avoid severe penalties and data breaches.This compliance includes:

- Secure networks: Establishing firewalls and othre security measures to protect cardholder data.

- Access control: Limiting access to sensitive data to authorized personnel only.

- Monitoring and testing: Regularly checking networks for vulnerabilities and ensuring security protocols are up to date.

to give a clearer picture of how security features differ between gateways and processors, here’s a simplified comparison:

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Encryption | Yes | Yes |

| Tokenization | Common | Less common |

| PCI Compliance | required | Mandatory |

| Fraud Prevention Tools | Advanced | Standard |

the security aspect of payment gateways and processors is not merely an add-on but a fundamental component that ensures safe and efficient online transactions. As businesses and consumers continue to rely on digital payments, prioritizing security in these systems will be crucial to foster trust and maintain a safe transaction surroundings.

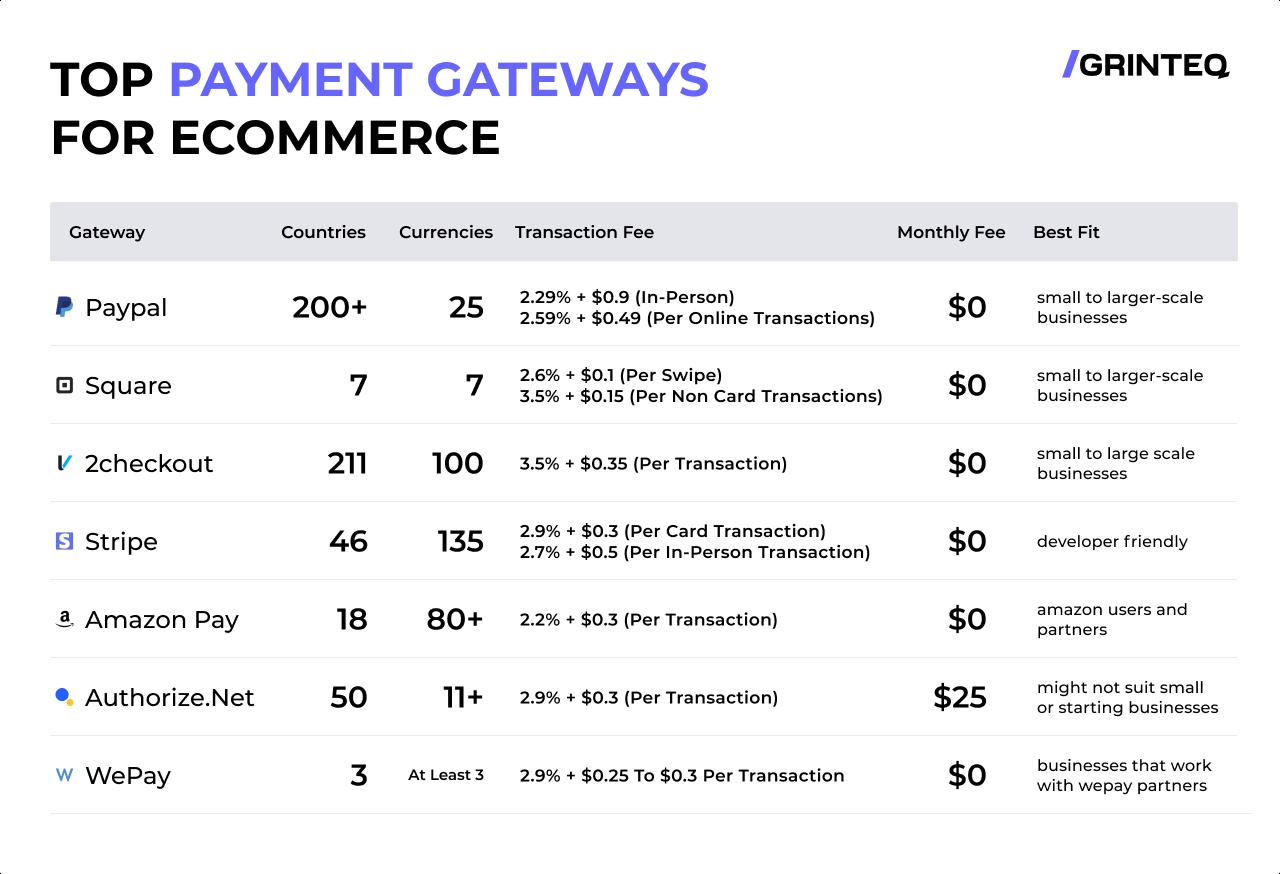

Choosing the Right Payment Gateway for Your Business Needs

When it comes to selecting a payment gateway for your business, understanding the nuances between various options is crucial. A payment gateway is essentially the technology that facilitates online transactions, acting as the intermediary between your customer and your bank. To ensure you choose the right one, consider the following factors:

- Transaction Fees: Different gateways have varying fee structures, including per-transaction fees, monthly fees, and commissions. Assess your business model to determine which structure will be most cost-effective in the long run.

- Integration: Ensure that the payment gateway easily integrates with your existing e-commerce platform. A seamless integration will save you time and headaches down the line.

- Security Features: Look for gateways that offer robust security measures such as PCI compliance, encryption, and fraud detection. The safety of your customers’ data should be a top priority.

- Payment Options: Check whether the gateway supports a variety of payment methods, including credit cards, digital wallets, and even cryptocurrencies. the more options you provide,the higher the chances of completing a sale.

- Customer Support: 24/7 support can be invaluable, especially during peak business times. Make sure the gateway you choose offers reliable assistance when you need it most.

To illustrate the differences among some popular payment gateways, here’s a quick comparison:

| Payment Gateway | Transaction Fees | Integration | Support |

|---|---|---|---|

| Stripe | 2.9% + 30¢ | Easy (API) | 24/7 |

| PayPal | 2.9% + 30¢ | Simple (Plugin) | Limited |

| Square | 2.6% + 10¢ | Highly Compatible | Business Hours |

As you weigh your options,remember that the best payment gateway is one that not only aligns with your budget but also enhances your customers’ shopping experience. Take the time to read reviews, consult with peers, and even test a few gateways if possible to see which feels right for your brand.

Evaluating Payment Processors: What to Look for

When evaluating payment processors,several key factors come into play that can significantly influence the efficiency and effectiveness of your online transactions. understanding these elements will empower you to make informed decisions that align with your business needs and customer expectations.

First and foremost,consider the transaction fees associated with each payment processor. While some may advertise low upfront costs, hidden fees can quickly add up, impacting your bottom line. look for processors that offer obvious pricing structures, ensuring you understand what you’ll pay for each transaction, including any monthly fees, chargeback fees, or international transaction costs.

Another vital aspect is security features. In today’s digital landscape, safeguarding customer data is paramount. Ensure that the payment processor you choose complies with the latest PCI DSS standards and offers features like tokenization and encryption.This not only protects your customers’ sensitive information but also helps build trust in your business.

Don’t overlook the ease of integration with your existing systems. The payment processor should seamlessly integrate with your e-commerce platform, whether it’s WooCommerce, Shopify, or custom-built solutions. This minimizes technical headaches and allows for a smoother customer experience, which can lead to higher conversion rates.

Lastly, take into account the customer support offered by the payment processor. Having prompt and effective support can be a lifesaver if technical issues arise. Look for processors that provide 24/7 support, multiple contact methods (like chat, email, and phone), and a comprehensive knowledge base to assist you and your customers whenever needed.

| Factor | Importance |

|---|---|

| Transaction Fees | Directly impacts profitability |

| Security Features | Protects customer data and builds trust |

| Integration Ease | Enhances user experience and efficiency |

| Customer Support | Essential for timely problem resolution |

Cost considerations: comparing Fees of Gateways and processors

When evaluating the costs associated with payment gateways and payment processors,it’s essential to dig deeper into their fee structures to understand how they impact your bottom line. While both serve critical roles in handling transactions, their fee models can vary significantly, influencing your overall payment strategy.

Payment Gateways typically charge fees that can be categorized into several types:

- Setup Fees: Many gateways require an initial setup fee,which can be a one-time charge to get your account up and running.

- Monthly Fees: Some gateways impose a recurring monthly fee for the use of their services, which can accumulate over time.

- Transaction Fees: These are fees charged for each transaction processed through the gateway. They can either be a flat rate or a percentage of the transaction amount.

- Chargeback Fees: In cases of disputes, payment gateways may levy charges for managing chargebacks, adding another layer to your costs.

Conversely, Payment Processors also have their unique set of fees, which can include:

- Transaction Fees: Similar to gateways, processors often charge a percentage of each transaction, which is crucial to consider as your sales volume grows.

- Monthly Fees: Some processors may charge a flat monthly fee for their services, which can vary based on the plan you choose.

- Discount Rate: This is the percentage of each transaction that goes to the processor. It’s essential to negotiate this rate, especially for high-volume businesses.

To provide a clearer picture, here’s a simple comparison of typical fees associated with both services:

| Fee Type | Payment Gateway | Payment Processor |

|---|---|---|

| Setup Fee | $0 – $500 | $0 – $300 |

| Monthly Fee | $10 - $100 | $0 - $50 |

| Transaction Fee | $0.30 + 2.9% | $0.15 + 2.5% |

| Chargeback Fee | $15 – $25 | $20 – $30 |

Understanding these costs is paramount in making an informed decision. While a payment gateway may have higher initial fees, the security features and customer experience it offers could justify the expense. Conversely, a payment processor with lower fees might provide a more attractive option for businesses with a smaller transaction volume. ultimately, evaluating your specific needs against the fee structures of both gateways and processors will help you choose the best solution for your business.

Integrating Payment Solutions: Simplifying Your Checkout Experience

When it comes to online transactions, understanding the difference between a payment gateway and a payment processor is crucial for enhancing your checkout experience.While they are often used interchangeably, each plays a specific role in facilitating a secure and efficient payment process for your customers.Let’s break down these components to help you make informed decisions.

A payment gateway acts as the bridge between your website and the financial institutions involved in the transaction. It securely captures and transmits customer payment information, allowing for a seamless checkout experience.Here are some of the key functions of a payment gateway:

- Encryption: Secures sensitive information during transmission.

- Authorization: Validates the payment details with the customer’s bank.

- Integration: Easily integrates with various e-commerce platforms.

Conversely, a payment processor handles the actual transaction processing. Once the payment information is authenticated, it’s the processor’s job to communicate with the bank to facilitate the transfer of funds. Consider the following roles of a payment processor:

- Transaction Management: Manages the entire transaction lifecycle from initiation to settlement.

- funding: Transfers the funds to your merchant account.

- Reporting: Provides insights and analytics on transaction trends.

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Data Encryption | ✔️ | ✖️ |

| transaction Authorization | ✔️ | ✔️ |

| Funds Transfer | ✖️ | ✔️ |

| Analytics & Reporting | ✖️ | ✔️ |

while both components are essential for a smooth payment process, they serve different purposes. Understanding these differences empowers you to choose the right solution that meets your business needs and enhances your customers’ checkout experience.By integrating effective payment solutions, you can minimize cart abandonment and ensure that your customers enjoy a hassle-free shopping journey.

Future Trends in Payment Technology: What to Expect

The payment landscape is evolving rapidly, driven by technological advancements and changing consumer preferences. As we look ahead, several key trends are emerging that will shape how we conduct transactions in the future.

contactless Payments: The adoption of contactless payment methods is expected to surge. With the convenience of tapping cards or smartphones, consumers are drawn to the speed and simplicity of these transactions. This trend is not just limited to retail but is expanding into public transport and various service sectors.

Cryptocurrency Integration: As cryptocurrencies gain more mainstream acceptance, we can expect payment processors to integrate digital currencies into their platforms. this will allow businesses to tap into a new customer base while offering versatility and security in transactions.

Enhanced Security Features: With the rise in digital transactions, security remains a top priority. payment technology will increasingly focus on advanced security measures, such as biometric authentication and AI-driven fraud detection systems.This will foster trust among consumers,encouraging them to embrace digital payments.

AI and Machine learning: The future of payment technology will harness the power of AI and machine learning. These technologies can analyze consumer behavior and transaction patterns to provide personalized payment solutions and improve user experience. Businesses can leverage this data to target customers more effectively, optimizing their marketing strategies.

Omnichannel Payment Solutions: As consumers interact with brands across multiple platforms,the need for seamless omnichannel payment solutions will increase. companies will focus on integrating payment systems across online, in-store, and mobile channels, ensuring a cohesive experience for the customer no matter where they shop.

Making the Right Choice: Recommendations for Your Business Model

Choosing between a payment gateway and a payment processor is crucial for your business model. Both play vital roles in managing transactions, but they serve different purposes. Understanding these distinctions will empower you to make informed decisions that align with your business needs.

Payment Gateway: Think of this as the digital equivalent of a cashier at a physical store. A payment gateway is responsible for transmitting transaction information securely between the customer and your payment processor.It is essential for online businesses that require secure transactions. Key features include:

- Security: Protects sensitive customer data through encryption.

- User Experience: Provides a seamless checkout experience for customers.

- Integration: Compatible with various e-commerce platforms and shopping carts.

Payment Processor: This is the behind-the-scenes player that manages the transaction once the payment gateway has done its job. The payment processor communicates with the customer’s bank to authorize payments and transfer funds to your merchant account. You should consider the following when choosing a payment processor:

- Fees: Understand the transaction fees, monthly charges, and any hidden costs.

- Speed: Look for processors that offer quick fund transfers.

- Support: Ensure they provide reliable customer service to resolve any issues promptly.

It’s essential to recognize how these two components work together. A payment gateway initiates and encrypts the transaction, while the payment processor completes it. For an effective payment solution, businesses often benefit from integrating both. To help visualize this, refer to the table below:

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Primary Function | Secure transaction initiation | Transaction execution |

| Data Security | Yes | No |

| Customer Interaction | High | Low |

| Fees | Varies | Transaction-based |

aligning your choice of payment gateway and processor with your business model is essential for optimizing customer experience and financial efficiency. weigh the pros and cons, and don’t hesitate to consult with experts to tailor a solution that best fits your operational goals.

Frequently Asked Questions (FAQ)

Q&A: Payment Gateway vs Payment Processor - What Are the Differences?

Q1: What exactly is a payment gateway?

A1: Great question! A payment gateway is essentially the technology that facilitates the transfer of information between a customer and a merchant when a transaction is made. Think of it as a digital bridge that securely collects and sends payment details to the payment processor. It ensures that sensitive data, like credit card numbers, is encrypted and safe during the transaction.

Q2: Okay, so how does that differ from a payment processor?

A2: Fantastic follow-up! A payment processor is the entity that actually handles the transaction once the payment information is collected by the gateway. It takes the payment details, verifies them with the bank, and processes the payment. In simpler terms, while the gateway is the starting point that collects the payment info, the processor is the behind-the-scenes hero that makes sure the funds are transferred from the customer’s bank to the merchant’s account.

Q3: Why can’t I just use one or the other? Don’t they do the same thing?

A3: It’s a common misconception! While they are closely related, they serve distinct roles that are both crucial for a smooth transaction. Using just one might leave you vulnerable or lead to a less efficient process. Think of it like a concert: the payment gateway is the ticket collector at the entrance, while the payment processor is the one managing the entire audience inside. You need both for a seamless experience!

Q4: Can I choose any payment gateway and processor?

A4: Absolutely, but it’s important to choose ones that integrate well together! Many companies offer both services as a package, which can simplify things for you. It’s wise to look for compatibility, security features, transaction fees, and customer support. After all, you wont to ensure your business runs smoothly without any hiccups when it comes to payments.

Q5: What should I consider when selecting a payment gateway and processor?

A5: Great question! Here are a few key factors to consider:

- Security: Look for encryption and compliance with industry standards like PCI-DSS.

- Fees: Understand the cost structure, including transaction fees, monthly costs, and any hidden charges.

- Integration: Make sure they can easily integrate with your existing e-commerce platform or website.

- Customer Support: Reliable support can make a big difference when issues arise.

Q6: why does this matter for my business?

A6: Choosing the right payment gateway and processor can significantly impact your customer experience and, ultimately, your bottom line. A seamless payment process can lead to higher conversion rates, fewer abandoned carts, and happier customers. Plus,ensuring security and efficiency can build trust and loyalty,which are essential for long-term success. So don’t overlook these critical tools—they’re the backbone of your business!

Q7: Any final tips for businesses navigating this landscape?

A7: Definitely! Take the time to research and even test out a few options before committing. Look for reviews and testimonials, and consider reaching out to customer support to gauge responsiveness. Remember, a little upfront effort can save you time, money, and headaches in the long run. And always keep your customers’ experience front and centre—after all, happy customers are repeat customers!

final Thoughts

As we wrap up our deep dive into the world of payment gateways and processors, it’s clear that understanding the differences between these two vital components can make a critically important difference for your business. Choosing the right tools can streamline your transactions, enhance customer experiences, and ultimately boost your bottom line.So, whether you’re just starting out or looking to optimize your existing setup, take the time to evaluate your needs and explore your options. Remember,a seamless payment experience isn’t just a nice-to-have; it’s a must in today’s fast-paced digital economy.

Now that you’re armed with this knowledge, why not take the next step? Review your current payment systems, consider how a payment gateway or processor can fit into your strategy, and don’t hesitate to reach out for expert advice if you need it. your customers—and your wallet—will thank you! happy transacting!