Are you ready to take your online store to the next level? If you’re diving into the world of eCommerce, one of the most crucial elements you’ll need to master is payment processing. It might seem a bit daunting at first, but don’t worry—we’re here to help you navigate this essential aspect of your business. In this comprehensive guide, we’ll walk you through the top seven payment processing services that can simplify transactions, enhance security, adn ultimately boost your sales. Whether you’re just starting out or looking to upgrade your current solution, understanding your options can make all the difference. So, let’s explore the best in the biz and set you on the path to eCommerce success!

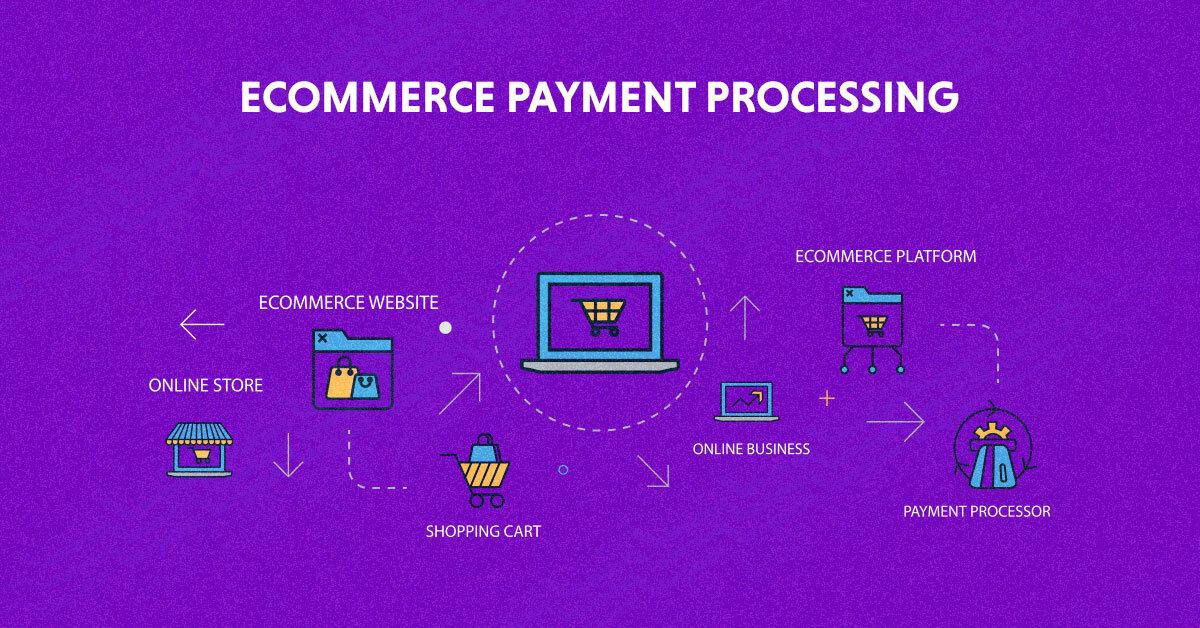

Understanding Ecommerce Payment Processing Essentials

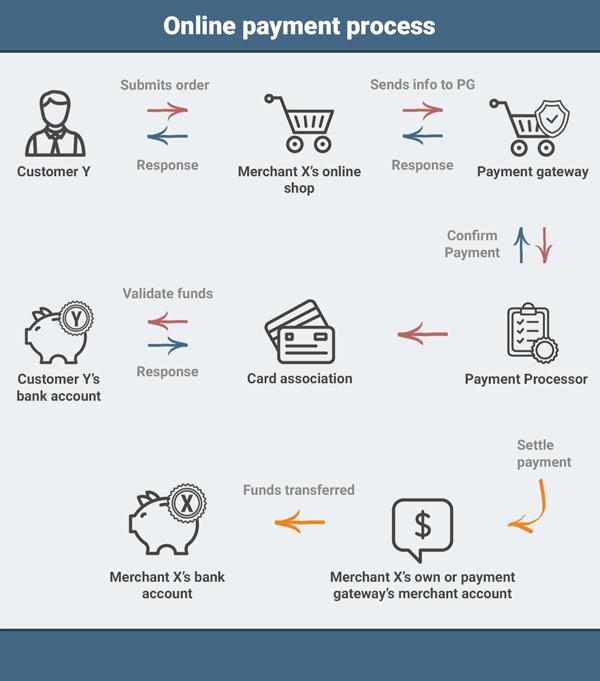

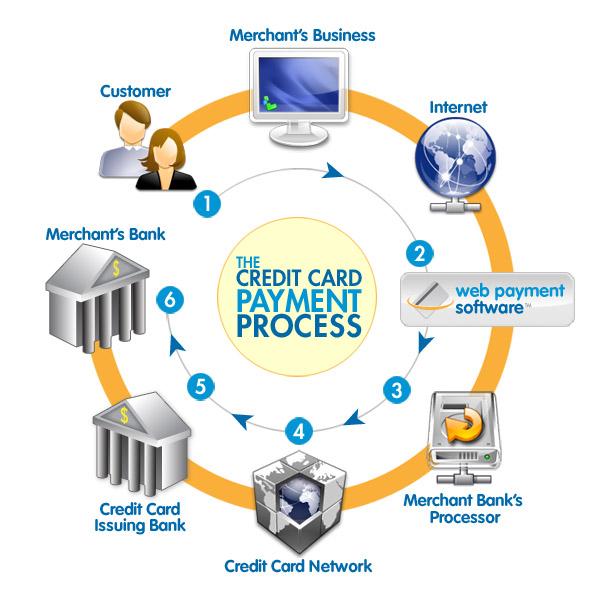

When diving into the world of ecommerce, understanding payment processing is crucial for both online retailers and customers. Payment processing encompasses the entire lifecycle of a transaction, from when a customer clicks ‘buy’ to when the funds are transferred to the merchant’s account. It involves various entities, including the customer, the merchant, the payment gateway, and the acquiring bank, each playing a vital role in ensuring a smooth transaction.

One of the first steps in setting up your ecommerce payment processing is choosing the right payment gateway. This technology facilitates the transfer of customer payment information to the merchant’s bank. Popular options include:

- PayPal – Known for its security and ease of use.

- Stripe – Offers extensive customization and integration options.

- Square – Great for both online and in-person transactions.

Onc you’ve selected a payment gateway, you’ll also need to consider the types of payments you want to except. The more options you provide, the easier it is for customers to complete their purchases.common payment methods include:

- Credit/Debit Cards – The most widely used payment method.

- Digital Wallets – Services like Apple Pay and Google Pay are gaining popularity.

- BANK TRANSFERS - Ideal for larger transactions.

Security is another critical element of payment processing. Customers need to trust that their sensitive information is safe. Implementing measures such as SSL certificates, PCI compliance, and fraud detection tools can significantly enhance security. Remember, a secure payment processing system not only protects your customers but also builds your brand’s reputation.

understanding the fees associated with different payment processing services is essential for maintaining profitability. Here’s a simple breakdown of typical fees:

| Service | Transaction Fee | Monthly fee |

|---|---|---|

| PayPal | 2.9% + $0.30 | $0 |

| Stripe | 2.9% + $0.30 | $0 |

| Square | 2.6% + $0.10 | $0 |

by grasping the essentials of payment processing, you can create a seamless shopping experience that drives sales and customer loyalty. The right tools and strategies will not only facilitate transactions but also foster trust and satisfaction among your users.

Choosing the Right Payment Gateway for Your Business

When it comes to selecting a payment gateway, businesses need to consider a variety of factors to ensure they choose a service that not only fits their needs but also enhances the overall customer experience. The right payment gateway can significantly impact your sales process, so it’s vital to take the time to evaluate your options carefully.

First and foremost, transaction fees can vary widely between providers. It’s essential to look beyond just the percentage cut and consider how those fees will affect your bottom line. Some gateways charge a monthly fee, while others may have a pay-as-you-go model.Understanding these costs upfront can definitely help you avoid unexpected expenses down the line.

Additionally, payment options offered by the gateway play a crucial role. Today’s consumers expect flexibility; therefore, providing a range of payment methods—from credit cards and digital wallets to bank transfers—can enhance user satisfaction and reduce cart abandonment rates. Make sure to choose a gateway that supports popular platforms like PayPal,Stripe,and apple Pay to capture a broader audience.

Security features are another critical consideration. With increasing concerns over data breaches and fraud, ensuring that your payment gateway complies with PCI DSS standards is non-negotiable. look for gateways that offer advanced encryption, fraud detection tools, and robust customer support to handle any issues that arise swiftly.

consider the integration capabilities of the payment gateway with your existing eCommerce platform. A seamless integration process can save you time and effort, allowing you to focus on growing your business rather than troubleshooting technical issues. Check for compatibility with your shopping cart system and whether they provide APIs for customization.

| Payment gateway | Transaction Fee | Supported Payments | Security Features |

|---|---|---|---|

| PayPal | 2.9% + $0.30 | Credit Cards, PayPal Balance | PCI Compliance, Fraud Protection |

| Stripe | 2.9% + $0.30 | Credit Cards, Digital Wallets | Strong Encryption, 3D Secure |

| Square | 2.6% + $0.10 | Credit Cards, ACH Transfers | PCI Compliance, Advanced Fraud Detection |

| Authorize.Net | 2.9% + $0.30 | Credit Cards, eChecks | Fraud Detection Suite, Secure Customer Data |

Exploring the Top Seven Payment Processing Services

When it comes to running an online store, choosing the right payment processing service is crucial. Not only does it affect your bottom line, but it also impacts customer experience. Here’s a look at some of the leading options available, each offering distinct advantages tailored to different business needs.

- PayPal – A household name in online transactions,PayPal is user-friendly and widely trusted by consumers. Its fast setup and extensive buyer protection policies make it an excellent choice for small to mid-sized businesses.

- Stripe – Known for its developer-friendly interface, Stripe offers customizable payment solutions ideal for tech-savvy ecommerce businesses. With its robust API, you can seamlessly integrate it into your site and provide various payment options.

- Square - Originally designed for brick-and-mortar businesses, Square has expanded into the online realm, offering a comprehensive suite of tools for ecommerce. Its flat-rate pricing structure simplifies budgeting, making it a favorite among small business owners.

- Authorize.net – A pioneer in online payment processing, Authorize.net provides flexible and secure solutions, including recurring billing options. This service is perfect for subscription-based businesses looking to streamline their transactions.

- Braintree – As a subsidiary of PayPal, Braintree enhances user experience with its mobile-first approach. It allows for seamless in-app payments, making it an excellent choice for businesses focusing on mobile commerce.

- Adyen – For larger enterprises, Adyen offers a powerful, all-in-one payment solution that supports multiple currencies and locations. Its robust analytics tools can definitely help you optimize your payment strategy and improve customer experience.

- 2Checkout – Ideal for global sales, 2Checkout allows merchants to easily reach international customers with support for multiple languages and currencies.Its user-friendly dashboard simplifies managing transactions across borders.

| Service | Best For | Notable feature |

|---|---|---|

| PayPal | Small to Mid-sized Businesses | Buyer Protection |

| Stripe | Developers | Custom API Integration |

| Square | Brick-and-Mortar Stores | Flat-rate Pricing |

| Authorize.net | Subscription Services | Recurring Billing |

| Braintree | Mobile Commerce | In-app Payments |

| Adyen | Large enterprises | Multi-Currency Support |

| 2Checkout | Global Sales | multi-Language Support |

Choosing the right payment processing service can significantly affect your ecommerce success. Consider factors like transaction fees, customer service, and the specific needs of your business when making your selection. By aligning your payment processing with your business model, you can enhance customer satisfaction and streamline your operations.

Comparing Fees and Features of Leading Providers

When diving into the world of ecommerce payment processing, understanding the fee structures and features of different providers is crucial for making an informed decision. Each service offers a distinct combination of transaction fees, monthly fees, and additional costs that can significantly impact your bottom line.

Transaction fees are typically the most scrutinized aspect. Most providers charge a percentage of the sale plus a fixed fee per transaction. This can vary widely, so it’s crucial to examine:

- Percentage of Sale: Ranges from 1.5% to 3.5%

- Fixed Fee: Usually between $0.10 to $0.30 per transaction

- International Transaction Fees: often higher, around 1% to 2%

In addition to transaction fees, monthly fees can also add up. Some providers offer no monthly fee,while others may charge:

- Flat Monthly Fee: Typically between $10 and $50

- Subscription Plans: Offering premium features at a higher cost

Next,consider the features that come with each service. The right provider will not only meet your basic payment processing needs but also enhance your overall ecommerce experience. Key features to look for include:

- Mobile Payment Options: Essential for today’s on-the-go consumers

- Integration Compatibility: Seamless integration with your existing ecommerce platform

- Fraud Prevention Tools: Measures to protect against chargebacks and fraud

- Customer Support: Availability of 24/7 support can save headaches down the line

| Provider | Transaction Fee | Monthly Fee | Key Features |

|---|---|---|---|

| Provider A | 2.9% + $0.30 | $0 | Mobile Payments, 24/7 Support |

| Provider B | 2.5% + $0.20 | $10 | Fraud Prevention, Easy Integration |

| provider C | 3.5% + $0.25 | $20 | Subscription Plans, Mobile-friendly |

Ultimately, the goal is to find a payment processing provider that aligns with your business model and customer preferences.balancing fees with essential features will ensure a smooth transaction experience, fostering customer trust and satisfaction while maintaining your profit margins.

Enhancing Security Measures for Online Transactions

In today’s digital landscape, ensuring the safety of online transactions is paramount for both businesses and consumers.To foster trust and confidence, it’s essential to implement robust security measures that protect sensitive information during payment processing. here are some key strategies to enhance security:

- SSL Certificates: secure Socket Layer (SSL) certificates encrypt data transferred between your website and customers,making it nearly impractical for hackers to intercept confidential information.

- Two-Factor Authentication (2FA): Implementing 2FA adds an extra layer of security, requiring users to verify their identity through a second device or method, significantly reducing the risk of unauthorized access.

- Regular Security audits: Conducting periodic reviews of your security systems helps identify vulnerabilities and ensure that your payment processing infrastructure remains secure against emerging threats.

- Fraud Detection Tools: Utilize advanced fraud detection software that analyzes transaction patterns in real-time, flagging suspicious activities before they escalate into meaningful issues.

- Compliance with PCI DSS: Adhering to the Payment Card Industry Data Security Standard (PCI DSS) is vital for any business that processes credit card payments.This compliance ensures that you meet rigorous security standards to safeguard cardholder data.

Furthermore, educating your team about cybersecurity practices can significantly impact your overall security posture. Consider implementing regular training sessions that cover:

- Recognizing phishing attempts

- Best practices for password management

- Safe handling of customer data

Lastly, establishing a clear response plan for potential security breaches is crucial.This plan should include:

| Step | Action |

|---|---|

| 1 | Immediate containment of the breach |

| 2 | Assessment of the scope and impact |

| 3 | Notification of affected parties |

| 4 | Investigation and resolution of the issue |

| 5 | Review and update security measures |

By prioritizing these security measures, businesses can not only protect themselves and their customers but also enhance their reputation and foster long-term loyalty. Stay proactive and vigilant,as the landscape of online transactions continues to evolve.

Streamlining Checkout for Higher Conversion Rates

In today’s fast-paced digital landscape, an efficient checkout process can make or break your ecommerce success. When consumers are ready to buy, every second counts. A streamlined checkout experience reduces cart abandonment rates and ensures a smooth transition from browsing to purchasing.

To achieve a seamless checkout,consider implementing the following strategies:

- Simplify Form Fields: Limit the number of fields required at checkout. Ask for only essential information to reduce friction.

- Guest Checkout Option: Allow customers to check out without creating an account. This caters to users who prefer quick transactions.

- Mobile Optimization: Ensure that your checkout process is fully optimized for mobile devices, as a significant portion of traffic comes from smartphones.

- Progress Indicators: Use progress bars to inform customers where they are in the checkout process, making it feel less daunting.

- Multiple Payment Options: Offer a variety of payment methods to cater to different preferences.This includes credit cards, digital wallets, and even buy-now-pay-later services.

Another key element in enhancing your checkout process is to reduce any surprise fees. Hidden charges can led to frustration and abandonment. Clearly display all costs upfront,including shipping and taxes,to build trust and improve conversion rates.

Lastly, consider implementing a one-click checkout option for returning customers. This requires minimal information input and speeds up the purchasing process significantly. As customers become accustomed to convenience, they’re more likely to return to your site for future purchases.

| Payment Method | Pros | Cons |

|---|---|---|

| Credit Cards | Widely accepted,fast transactions | Potential for fraud |

| Digital Wallets | Convenient,secure | Requires user setup |

| Buy Now,pay Later | Increases affordability | Debt accumulation risks |

By prioritizing a user-friendly checkout process,you not only enhance the shopping experience but also significantly boost your conversion rates. Remember, the goal is to make the purchase journey as effortless as possible, turning casual browsers into loyal customers.

Leveraging Mobile Payments for On-the-go Shoppers

Maximizing Convenience for On-the-Go Shoppers

In today’s fast-paced world, shopping has evolved far beyond conventional methods. With the rapid growth of mobile payment solutions, consumers can now complete transactions swiftly and securely from the palm of their hand. This seamless integration of technology into shopping experiences caters especially to those who are always on the move, allowing them to enjoy their favorite brands without the hassle of lengthy checkout processes.

Embracing mobile payments not only benefits shoppers but also provides ample advantages for businesses. Here’s why you should consider implementing mobile payment solutions:

- Speed: Transactions are completed in seconds,reducing wait times and enhancing customer satisfaction.

- Accessibility: Customers can shop anytime and anywhere, making it easier for them to make spontaneous purchases.

- Security: Advanced encryption and tokenization protect sensitive customer data, building trust and loyalty.

Additionally, integrating mobile payment options into your ecommerce platform can lead to increased sales. Consumers are more likely to complete a purchase when they can use their preferred payment method without delay. Here’s how you can effectively leverage this technology:

| Strategy | Description |

|---|---|

| Offer Multiple payment Options | Include various mobile payment solutions such as Apple Pay, Google Pay, and PayPal to cater to diverse customer preferences. |

| Optimize for Mobile | Ensure that your website is mobile-friendly, providing a smooth browsing and checkout experience on smaller screens. |

| Promote Offers | Encourage customers to use mobile payments by providing exclusive discounts or rewards for using these options. |

Moreover, incorporating analytics allows you to monitor customer behavior and optimize your mobile payment strategy accordingly. By analyzing the data, you can identify trends, such as peak shopping times and popular products, to refine your marketing efforts. This insight empowers you to stay ahead of the competition and continually meet the evolving needs of your customers.

Ultimately, mobile payments not only streamline the shopping experience but also position your brand as forward-thinking and customer-centric. With the right approach, you can transform casual browsers into loyal customers who appreciate the convenience and efficiency you provide.

Integrating Payment Solutions with Your Ecommerce Platform

When it comes to ecommerce, the right payment solution is crucial for both you and your customers. Integrating a payment gateway can streamline transactions, improve customer satisfaction, and enhance your overall business efficiency. the key is to choose a solution that aligns with your ecommerce platform, ensuring a seamless experience for everyone involved.

Here are some essential factors to consider when integrating payment solutions:

- Compatibility: Ensure that the payment gateway you choose is compatible with your ecommerce platform. popular platforms like WooCommerce, Shopify, and Magento frequently enough have built-in options or plugins that facilitate this integration.

- Transaction Fees: Different payment processors have varying fee structures. It’s important to analyze these fees and understand how they impact your profit margins.

- User Experience: The checkout process should be simple and quick.A elaborate or lengthy process can lead to cart abandonment, so opt for solutions that offer a smooth user experience.

- Security Features: Customer trust is paramount in ecommerce. Look for payment gateways that provide robust security features, such as SSL encryption and PCI compliance, to protect sensitive information.

- Currency options: If you sell internationally, consider a payment solution that supports multiple currencies to cater to a broader audience.

to visualize the differences between various payment solutions, here’s a quick comparison table:

| Payment Processor | Transaction Fee | Supported Currencies | Security Features |

|---|---|---|---|

| PayPal | 2.9% + $0.30 | 140+ | SSL, PCI compliance |

| Stripe | 2.9% + $0.30 | 135+ | SSL, PCI Compliance |

| Square | 2.6% + $0.10 | 1 | SSL, PCI Compliance |

moreover, consider implementing multiple payment options. Offering various choices can cater to different preferences and can even boost your conversion rates. Customers appreciate flexibility, and by providing a range of payment methods—from credit cards to digital wallets—you can create a more inclusive shopping environment.

integrating the right payment solution with your ecommerce platform is a game-changer. By carefully evaluating your options and prioritizing factors like compatibility,security,and user experience,you can create a seamless checkout process that delights your customers and drives your business forward.

Tips for Optimizing Your Payment Processing Strategy

To enhance your ecommerce payment processing,consider implementing the following strategies that not only improve customer experience but also streamline your operations:

- Choose the Right Payment Gateway: Ensure that your payment gateway supports multiple payment options,including credit cards,digital wallets,and local payment methods. This flexibility can significantly reduce cart abandonment rates.

- Prioritize Security: Invest in robust security measures like SSL certificates and PCI compliance to protect customer data.A secure checkout process builds trust and encourages repeat purchases.

- Optimize for Mobile: With an increasing number of transactions happening on mobile devices, ensure that your payment processing is mobile-friendly.Simplify the checkout process and minimize form fields for a seamless experience.

Additionally, utilizing data analytics can definitely help you fine-tune your strategy:

- Analyze Transaction Data: regularly review your transaction data to identify trends in customer behavior, such as peak shopping times and preferred payment methods.

- Test Different Checkout Flows: A/B testing different checkout flows can reveal what works best for your audience. Minor tweaks can lead to a significant increase in conversions.

- Integrate with Other Tools: Ensure your payment processing system integrates smoothly with your inventory management, CRM, and accounting software for better workflow efficiency.

| Payment Gateway | Key Feature | Suitable For |

|---|---|---|

| PayPal | Wide acceptance | Small to large businesses |

| Stripe | Developer-friendly | Tech-savvy businesses |

| Square | In-person and online payments | Retail businesses |

| Braintree | Seamless mobile integration | Mobile app developers |

By focusing on these areas, you can create a payment processing strategy that not only meets the needs of your customers but also boosts your business efficiency. Remember, a smooth payment experience can be a game-changer for customer retention and satisfaction.

Frequently Asked Questions (FAQ)

Q&A: Ecommerce Payment Processing Guide: Top 7 Services and More

Q1: Why is choosing the right payment processing service so important for my ecommerce business?

A1: Great question! Choosing the right payment processing service can make or break your ecommerce business. A reliable service ensures smooth transactions, enhances customer trust, and minimizes cart abandonment. Plus, it can save you money in fees and improve your cash flow. If your customers have a seamless checkout experience, they’re much more likely to complete their purchases!

Q2: What should I look for when selecting a payment processor?

A2: You’ll want to consider several factors, such as transaction fees, ease of integration with your existing ecommerce platform, security features, and customer support. additionally, think about the payment methods you want to accept—credit cards, digital wallets, or even cryptocurrencies. A good payment processor should cater to your business’s specific needs and your customers’ preferences.

Q3: Can you tell me about the top payment processing services available?

A3: Absolutely! Here are the top seven payment processing services you should consider:

- PayPal: A household name, it offers a simple setup and trusted security.

- Stripe: Known for its developer-friendly API, perfect for customizable ecommerce solutions.

- Square: Great for businesses that have both online and brick-and-mortar stores.

- Authorize.Net: A veteran in the industry, it provides robust fraud protection.

- Braintree: Owned by PayPal, it supports various payment types, including mobile payments.

- Adyen: A global player that offers a single platform for multiple payment methods.

- Amazon Pay: Leverages Amazon’s vast user base, allowing customers to check out using their Amazon accounts.

Each has its unique strengths, so it’s all about finding the right fit for your business!

Q4: What about security? How can I ensure my customers’ data is safe?

A4: Security is crucial in ecommerce! When evaluating payment processors, look for services that are PCI compliant, meaning they adhere to strict security standards.Features like encryption and tokenization are essential too, as they protect sensitive data. Most reputable processors will have robust security measures in place, but it’s always a good idea to ask about their protocols.

Q5: How do fees affect my profit margins?

A5: Fees can significantly impact your bottom line. Payment processors typically charge transaction fees, which can range from 1.5% to 3% per transaction, plus monthly or flat-rate fees.It’s important to analyze these costs carefully. A lower percentage fee might seem appealing, but hidden costs like chargeback fees or international transaction fees can add up. Always do the math to see how different fee structures affect your overall profitability.

Q6: How can I integrate a payment processor into my ecommerce site?

A6: Most payment processors offer straightforward integration guides, and many popular ecommerce platforms, like Shopify or WooCommerce, have built-in support for these services. You can usually set it up with just a few clicks. If you have a custom-built site, you might need a developer to help with the API, but many processors provide excellent documentation and support to make the process easier.

Q7: What if my business grows? Will my payment processor be able to keep up?

A7: That’s a great consideration! When choosing a payment processor, look for one that can scale with your business. Many of the top services offer features that cater to businesses of all sizes, from startups to enterprise-level operations. It’s wise to select a processor that not only meets your current needs but can also adapt as your business grows, offering additional features like multi-currency support or advanced analytics.

Q8: Any final advice for someone just starting out with ecommerce?

A8: Don’t rush your decision! Take your time to research and compare the different payment processing services available. Read reviews, ask for recommendations, and consider reaching out to customer support to gauge their responsiveness. Your choice will set the tone for your customer’s shopping experience, so invest the time to find the right partner. Happy selling!

Wrapping Up

As we wrap up our exploration of the top seven ecommerce payment processing services, it’s clear that choosing the right one can significantly impact your online business. The landscape of digital transactions is ever-evolving,and staying informed is key to ensuring you meet your customers’ needs while maximizing your profits.Whether you’re a seasoned entrepreneur or just starting out, remember that the right payment processor can not only streamline your operations but also enhance customer satisfaction and trust. from transaction fees to security features, take the time to weigh your options carefully. Your choice can set the tone for your entire business journey.

So, what’s next? We encourage you to dive deeper into the specifics of each service we’ve discussed.Consider your business model, target audience, and growth plans, and don’t hesitate to experiment until you find the perfect fit.After all, a seamless checkout experience could be the difference between a one-time buyer and a loyal customer.thanks for joining us on this journey through the world of ecommerce payment processing! If you have any questions or need further guidance, feel free to reach out. Happy selling, and here’s to your success in the digital marketplace!