Are you ready to dive into the world of e-commerce but feeling overwhelmed by the complexities of taxes? You’re not alone! Setting up a WooCommerce store on WordPress can be an exciting venture, but ensuring it’s tax-compliant without breaking the bank can feel like a daunting task.The good news? You don’t need to be a tax expert or a tech whiz to create a seamless, compliant shopping experience for your customers. In this article,we’ll guide you through the essential steps to build a WooCommerce store that not only meets tax regulations but does so without adding extra overhead to your business. So, grab a cup of coffee, and let’s simplify the process together—as you deserve to focus on what you do best: growing your business!

Understanding the Importance of Tax Compliance for Your WooCommerce Store

tax compliance is not just a bureaucratic necessity; it’s a significant aspect of running a successful WooCommerce store. For many entrepreneurs, the idea of tackling tax regulations can be daunting. However, understanding and adhering to tax laws can be the difference between prosperity and pitfalls in your business. Here’s why prioritizing tax compliance matters:

- Avoiding Penalties: Failing to comply with tax regulations can lead to hefty fines and penalties. These unexpected costs can eat into your profits and hinder your growth.

- building Trust: Customers value clarity and reliability.By ensuring that your WooCommerce store is tax-compliant, you enhance your credibility and foster trust with your clients.

- Streamlining Operations: Implementing a tax compliance strategy simplifies your financial processes. You’ll spend less time worrying about audits and more time focusing on scaling your business.

Moreover, tax compliance can considerably affect your pricing strategy. Understanding the tax implications on the products you sell enables you to set competitive prices while remaining profitable. Customers are frequently enough willing to pay a little extra for products from a store that they know is legitimate and compliant with the law. This can lead to increased sales and customer loyalty.

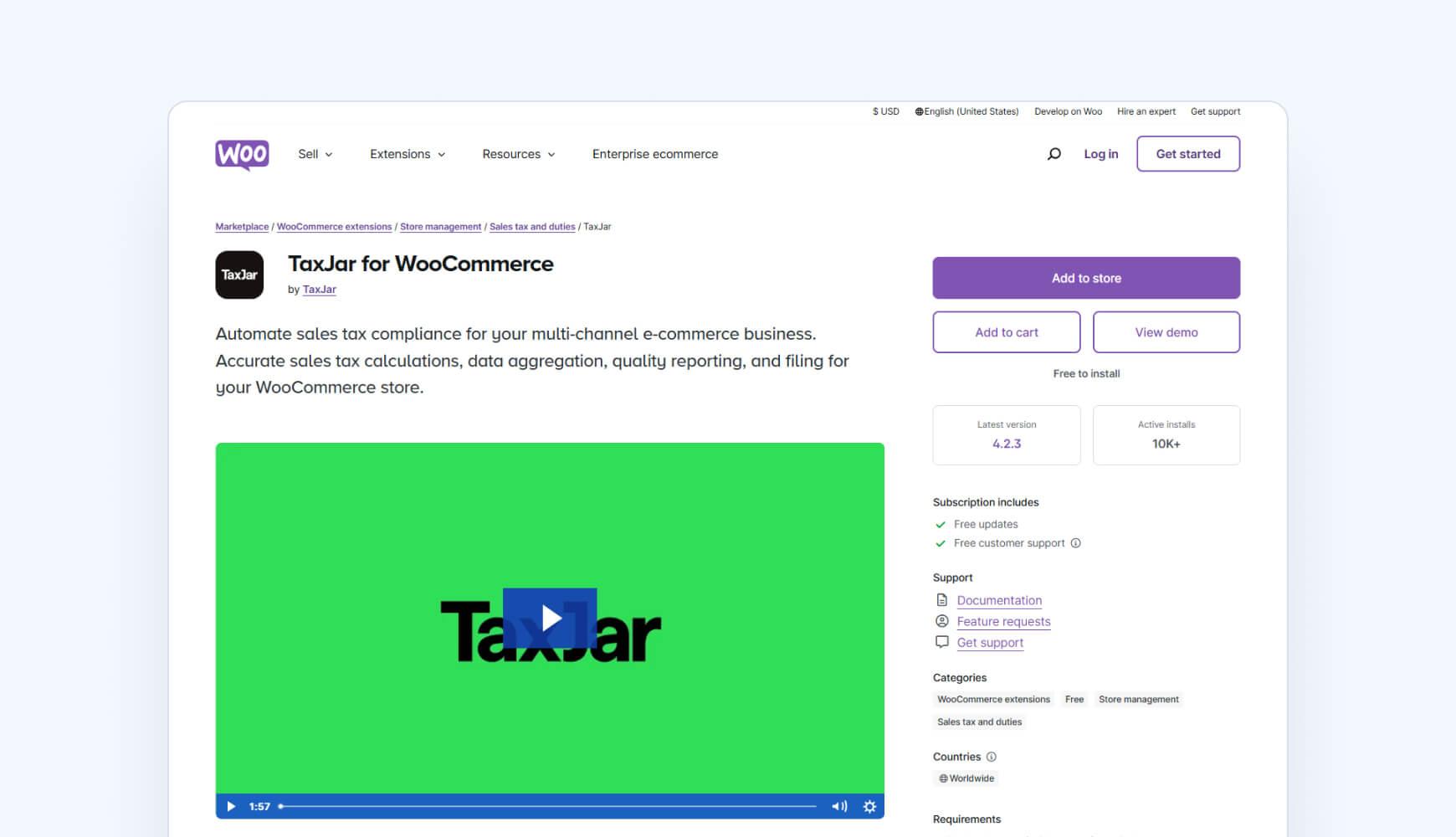

To navigate the complexities of tax compliance effectively, consider utilizing various tools and plugins designed for WooCommerce.These resources can automate tax calculations, ensuring you always charge the correct rates based on location and product type. Here’s a quick overview of some of these tools:

| Plugin Name | Features | Cost |

|---|---|---|

| WooCommerce Tax | Automatic calculations, tax class management | Free |

| TaxJar | Sales tax reporting, automated filing | Starts at $19/month |

| Avalara | Real-time tax calculations, compliance management | Custom pricing |

By adopting these tools, you not only ensure compliance but also free up valuable resources to invest in other areas of your business. Ultimately, understanding the importance of tax compliance equips you with the knowledge to protect your WooCommerce store, enhance its reputation, and drive profitability.

choosing the Right Tax Settings in WooCommerce for Your Business Model

When setting up tax settings in WooCommerce, it’s essential to align them with your specific business model. Understanding your sales channels, customer locations, and product types will guide you in configuring the right tax rates. Here are some key aspects to consider:

- Tax Classes: WooCommerce allows you to create different tax classes for various product types. Such as, you might have standard rates for physical goods and reduced rates for digital downloads. This feature helps ensure compliance with different tax requirements.

- Geolocation: Utilizing WooCommerce’s geolocation feature can help automatically determine the customer’s location and apply the appropriate tax rates. This is particularly useful if you have customers in multiple tax jurisdictions.

- Shipping Tax Options: Decide whether to charge tax on shipping costs. this can vary significantly based on your location and the nature of the products sold. Make sure to check local regulations to remain compliant.

Incorporating tax exemptions for certain customer groups may also be necessary. As an example, if you serve nonprofit organizations or wholesalers, you can set up exemptions in WooCommerce. This will ensure that you’re not overcharging tax for these particular transactions, wich can enhance customer satisfaction and loyalty.

Regularly review and update your tax settings to adapt to changing regulations. Tax laws can evolve, and missing updates can lead to compliance issues. WooCommerce provides built-in tools that notify you of changes in tax rates based on your settings, making it easier to stay informed.

Lastly, consider integrating a tax compliance tool that syncs with your WooCommerce store. This can automate the process, minimizing manual adjustments and reducing the potential for errors. Look for solutions that offer features such as:

| Feature | benefit |

|---|---|

| Real-time Tax Calculation | Ensures accurate tax rates are applied at checkout. |

| Reporting Tools | Simplifies tax reporting and filing processes. |

| Multi-Currency Support | Facilitates international sales with accurate conversions. |

By strategically choosing the right tax settings, you can create a seamless shopping experience for your customers while ensuring your woocommerce store remains compliant with tax regulations. This not only protects your business but also enhances your credibility in the marketplace.

Integrating Tax Calculation Plugins to Simplify Your Workflow

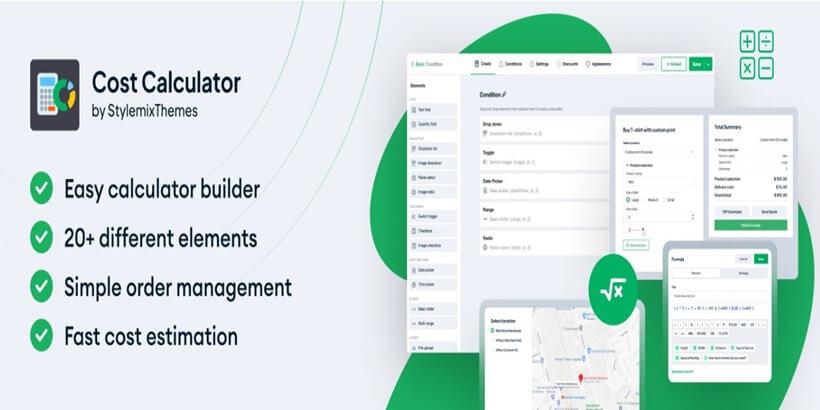

Integrating tax calculation plugins into your WooCommerce store can dramatically simplify your workflow, allowing you to focus more on running your business rather than wrestling with complex tax codes. By automating the tax calculation process, you can reduce errors and save valuable time. Here are a few key benefits of using these plugins:

- Accurate Calculations: Tax plugins automatically adjust rates based on the customer’s location, ensuring compliance with current tax laws.

- Real-Time Updates: Many plugins receive regular updates to reflect changes in tax legislation, so you can be confident that your store is always compliant.

- Seamless Integration: These plugins easily integrate with your WooCommerce setup, meaning you won’t have to overhaul your existing system to include them.

When selecting a tax calculation plugin, consider your specific needs. here’s a quick comparison table of popular tax plugins for WooCommerce, highlighting their key features:

| Plugin Name | Key Features | Price |

|---|---|---|

| TaxJar | Real-time rates, automated filing | $19/month |

| WooCommerce Tax | Built-in, easy to use | Free |

| Avalara | Complete tax compliance, global support | Custom pricing |

Once you’ve chosen the right plugin for your store, installation is generally straightforward. Simply download the plugin from the WordPress repository or the developer’s site, upload it to your WooCommerce installation, and configure your tax settings. Most plugins will guide you through the setup process, making it easy to select tax jurisdictions and rates according to your needs.

additionally, many tax calculation plugins come with features that can help you generate reports for accounting purposes.This can be a game-changer during tax season when you need to pull crucial data quickly. By having everything organized and readily available, you can save yourself from the headache of last-minute calculations and ensure that your business remains compliant without added stress.

Setting Up Automatic Tax Rates for Different Regions

Setting up automatic tax rates for various regions in your WooCommerce store is essential for ensuring compliance and providing a seamless shopping experience for your customers. With the right configuration, you can automate the tax calculation process, reducing manual work and minimizing errors. Here’s how to get started:

First, you’ll need to access your WordPress dashboard and navigate to the WooCommerce settings.Under the General tab,make sure that the option for Enable Taxes is checked.this will allow you to take advantage of WooCommerce’s built-in tax management features. Once enabled, you’ll see a new tab labeled Tax appear in the WooCommerce settings menu.

Next, go to the Tax settings and choose the appropriate tax calculation options. Here, you can specify how prices are displayed in your store—whether inclusive or exclusive of tax—and set your Shipping Tax Class. For most users, it’s beneficial to select the option to calculate tax based on the customer’s shipping address. This ensures that the correct tax rate is applied based on their location.

To set up automatic tax rates, you can use a combination of tax classes and rates. Create different tax classes for regions or products as needed. For instance, if you sell digital products that are taxed differently than physical goods, you might want to create separate classes.In the tax rates section, you can enter the necessary tax rates for each class by specifying the contry, state, and applicable tax percentage.

Here’s a simple representation of how your tax rates might look in a table:

| Region | Tax Rate (%) |

|---|---|

| California | 7.25 |

| New York | 8.875 |

| Texas | 6.25 |

| florida | 6.00 |

consider using a tax automation plugin like TaxJar or Avalara to further streamline the process. These tools integrate seamlessly with WooCommerce and automatically update your tax rates based on the latest regulations, ensuring your store is always compliant with regional tax laws. By implementing these solutions, you can focus more on growing your business rather than stressing over tax compliance.

Navigating Sales Tax Requirements: What You Need to Know

Understanding the intricacies of sales tax is crucial for any WooCommerce store owner. As you embark on your online selling journey, navigating the sales tax landscape doesn’t have to be overwhelming. Here are some essential considerations to keep your store compliant without incurring extra costs.

Firstly, it’s critically important to determine your tax nexus. This refers to the connection between your business and a taxing jurisdiction. Many states have specific criteria that can establish a nexus, such as:

- Physical presence: A brick-and-mortar store or warehouse.

- Selling goods in the state: Regular sales activities can create nexus.

- Affiliate relationships: Partnering with local affiliates might trigger tax obligations.

Once you understand where you have nexus, the next step is to set up your WooCommerce store to automatically calculate and collect sales tax. Fortunately, WooCommerce comes equipped with a robust solution:

- Built-in tax settings: You can easily enable tax calculations in the WooCommerce settings page.

- Geolocation support: Set your store to automatically detect customer location and apply the correct tax rates.

- Tax classes: Create tax classes for different product types to differentiate tax treatment.

Moreover, staying updated on tax rates is essential. Why not automate this process? Use plugins such as TaxJar or Avalara, which can keep your rates accurate and save you time managing compliance. Here’s a quick comparison:

| Plugin | Features | Pricing |

|---|---|---|

| TaxJar | Automatic rate updates, reporting | Starting at $19/month |

| Avalara | Comprehensive tax compliance, integration | Custom pricing |

don’t forget to keep thorough records of your sales and tax collected. This is not only for your peace of mind but also to ensure you’re prepared for any audits. Utilize WooCommerce reporting tools to track your sales data easily,making the reconciliation process smoother.

Creating Clear Tax Policies to Build Trust with Your Customers

Establishing clear tax policies is essential for any WooCommerce store looking to foster trust with its customers. When shoppers feel confident in the pricing of your products, they are more likely to complete their purchases. A transparent approach to tax policies not only enhances customer satisfaction but also minimizes potential disputes. Here are some key strategies to consider:

- Clearly Display Tax Facts: ensure that all pricing on your website includes taxes or clearly indicates whether they will be applied at checkout. Customers appreciate knowing the total cost up front.

- Provide Detailed Tax Breakdown: Implement a feature that allows customers to see how taxes are calculated. A simple breakdown can make a big difference in customer trust.

- Regular Updates on Tax Policies: Keep your customers informed about any changes in tax laws that might affect their purchases. This proactive dialog can reassure them that they are shopping with a responsible and compliant business.

Using the built-in features of WooCommerce, you can set up tax classes that automatically apply appropriate rates based on customer location. This not only simplifies your compliance efforts but also enhances the customer experience. Offering a straightforward checkout process that automatically calculates taxes can significantly reduce cart abandonment rates.

Another effective way to build trust is by creating a dedicated FAQ section on your website that addresses common tax-related questions. Here’s a simple table to illustrate some common inquiries:

| Question | Answer |

|---|---|

| Are taxes included in the price? | Yes, all prices include applicable taxes. |

| How are taxes calculated? | Taxes are based on your shipping address. |

| Can I see a tax breakdown? | Yes, a detailed breakdown will be provided at checkout. |

Lastly, always encourage customer feedback regarding your tax policies. By actively seeking and responding to their concerns, you can refine your approach and demonstrate that you value their input. This ongoing dialogue can strengthen the relationship with your customers, leading to increased loyalty and repeat business. In a world where transparency is key, a clear understanding of tax policies can make all the difference in positioning your WooCommerce store as a trusted marketplace.

Utilizing Reports and Analytics for Ongoing Tax compliance

One of the most effective ways to ensure you remain compliant with tax regulations is by leveraging reports and analytics offered by your woocommerce store. These tools provide a treasure trove of data that not only keeps you compliant but also helps you make informed business decisions. By regularly reviewing your sales reports, tax summaries, and customer data, you can identify trends and ensure that you are accurately reporting your tax obligations.

To get started, consider the following key reports that can aid in your tax compliance efforts:

- Sales Reports: Analyze total sales to different regions and states to understand your nexus and tax responsibilities.

- Tax Summary Reports: Review how much tax you’ve collected over specific periods, ensuring you’re remitting the correct amounts.

- Customer Purchase Behavior: Track which products are being purchased and by whom, giving you insights into potential audit triggers.

Utilizing these reports is not just about compliance; it’s about enhancing your overall business strategy. For example, if you notice an uptick in sales from a particular state, it could indicate a growing market that warrants further investment. This proactive approach minimizes the risk of hefty penalties due to misreporting and allows you to focus on growth.

integrating analytics tools like Google Analytics or WooCommerce’s built-in reports can streamline this process. You can set up automatic alerts for any discrepancies or unusual patterns in your sales data, ensuring that you stay ahead of potential issues.

Here’s a simple table to highlight the benefits of using analytics for tax compliance:

| Analytics Tool | Benefits |

|---|---|

| Sales Reports | Identify tax obligations by location |

| Tax Summary Reports | Ensure accurate tax remittance |

| Customer Behavior Analytics | Spot trends and potential audit risks |

utilizing reports and analytics isn’t just a checkbox for tax compliance—it’s a strategic advantage. By consistently monitoring your data,you can enhance your operational efficiency,drive sales,and maintain your peace of mind regarding tax obligations.incorporate these practices into your routine, and watch how they elevate your WooCommerce store’s performance while keeping you compliant.

Keeping Up with Changing Tax Laws: Tips for Staying Informed

Staying updated with the ever-evolving landscape of tax laws is crucial for anyone operating an online store, particularly those using WooCommerce on WordPress. With frequent changes and updates, it can be challenging to ensure your store remains compliant without incurring additional costs. here are some effective strategies to keep you informed and ready to adapt:

- Subscribe to Tax Newsletters: Sign up for newsletters from reputable tax organizations and financial news outlets. these can provide timely updates and insights directly to your inbox, ensuring you never miss critical changes.

- Follow Tax Blogs: Keep an eye on blogs dedicated to tax law and eCommerce. Many CPAs and tax professionals share their expertise through articles that analyze recent changes and offer practical advice.

- join Online Forums: Engage with communities on platforms like Reddit or specialized forums where tax professionals and eCommerce entrepreneurs discuss recent developments. This can be a great way to gain different perspectives.

- Utilize Tax Software: Invest in reliable tax compliance software that automatically updates its features in line with new laws. This minimizes manual research and helps ensure your store remains compliant.

Additionally, consider setting up a recurring schedule for tax regulation reviews. This could be monthly or quarterly, depending on your business’s complexity. Establish a checklist that includes:

| Review Frequency | Key Areas to Check |

|---|---|

| Monthly | Sales tax rates, compliance alerts |

| Quarterly | new tax filings, upcoming deadlines |

| Annually | Tax code updates, strategic planning |

By actively engaging with these resources and establishing a solid review routine, you can ensure your WooCommerce store remains compliant with current tax laws. This proactive approach not only alleviates the stress of unexpected changes but also demonstrates your commitment to legal and financial integrity, which can enhance your business reputation.

Maximizing Your Store’s profitability While Staying Compliant

Building a tax-compliant WooCommerce store on WordPress is essential for maximizing profitability while minimizing risks associated with non-compliance. One of the first steps is to ensure that your store is set up to automatically calculate taxes based on the locations of your customers. This can be accomplished using the built-in tax options in WooCommerce. Here’s how:

- Enable Local Taxes: Navigate to WooCommerce settings and enable tax calculations to allow your store to automatically apply taxes based on your customers’ shipping address.

- Set Up Tax Classes: Create tax classes for different types of products or services, ensuring the correct rates are applied.

- Use GeoIP Functionality: Leverage GeoIP plugins to automatically detect customer locations for accurate tax calculations.

Another vital aspect of maintaining compliance is keeping detailed records. It’s not just about collecting the right amount of tax; you also need to track it effectively. Consider integrating an accounting plugin that syncs with woocommerce. This integration provides:

- Automated Reports: Generate detailed sales and tax reports effortlessly.

- Expense Tracking: Easily monitor your expenses to ensure that you’re not overspending.

- Profitability Insights: Analyze your profit margins with precision to make informed decisions.

Additionally, make use of customer communication to clarify your tax policies. Transparency builds trust, which in turn can lead to increased sales.Here are some ways to communicate effectively:

- Clear Tax Information: Display tax rates prominently on product pages and during checkout.

- FAQ Section: Address common tax-related questions in your FAQ to reduce customer inquiries.

- Email Reminders: Send periodic emails reminding customers about your tax policies, especially during peak shopping seasons.

To summarize, a few additional strategies will help solidify your tax compliance while boosting your store’s profitability:

| Strategy | Benefit |

|---|---|

| Utilize Tax Automation Plugins | Saves time and reduces human error |

| regular Compliance Reviews | Stay updated with evolving tax laws |

| Professional Consultation | Expert guidance tailored to your business |

Common Mistakes to Avoid When Building Your Tax-Compliant Store

When setting up your WooCommerce store, it’s easy to overlook essential elements that ensure tax compliance. Here are some common pitfalls to steer clear of:

- Neglecting Sales Tax settings: Many store owners skip configuring their sales tax settings. Ensure you understand the tax regulations in your jurisdiction and input the correct rates in WooCommerce.This includes both state and local taxes.

- Ignoring Digital Goods Taxation: If you sell digital products, remember that they frequently enough have different tax implications. Research whether your region taxes digital goods differently and set your rates accordingly.

- Forgetting to Monitor Tax Changes: Tax laws are not static; they can change frequently. Stay updated on any changes in tax legislation that could affect your business and adjust your settings as necessary.

- Overlooking International Sales: if you plan on selling internationally, make sure to familiarize yourself with the tax obligations in those countries. Some may require you to collect and remit VAT or other taxes.

Another critical mistake is underestimating the importance of proper documentation.Keeping meticulous records can save you from hefty fines in the event of an audit. Consider implementing a system for:

| Document Type | Description |

|---|---|

| Invoices | Document all sales with detailed invoices for tax reporting. |

| Tax Returns | Keep copies of submitted tax returns for future reference. |

| Tax exemption Certificates | Store certificates from tax-exempt customers to validate sales tax exemptions. |

Lastly, don’t overlook the integration of reliable tax plugins with your WooCommerce store. These tools can automate tax calculations and ensure compliance without requiring extensive manual input. here’s what to consider when choosing a plugin:

- Compatibility: Ensure the plugin is compatible with your current version of WooCommerce and any other plugins you use.

- Ease of Use: Look for plugins that are user-friendly and have good documentation.

- Customer Support: Opt for plugins that offer reliable customer support in case you run into issues.

Frequently Asked Questions (FAQ)

Q&A: How to Build a Tax-Compliant WooCommerce Store on WordPress Without Extra Overhead

Q: Why is it important to ensure my WooCommerce store is tax-compliant?

A: Great question! Tax compliance is crucial for any online store.If you don’t comply with tax regulations, you could face hefty fines and penalties. Plus, being tax-compliant builds trust with your customers, showing them you operate a legitimate business.It’s all about keeping your business safe and your customers happy!

Q: Isn’t tax compliance complicated?

A: It can seem daunting at first, but with the right tools and knowledge, it’s absolutely manageable.woocommerce has built-in features and there are various plugins that can help simplify the process. You don’t have to be a tax expert – just follow a solid plan and use the resources available to you.

Q: What are the first steps to set up a tax-compliant WooCommerce store?

A: Start by understanding the tax laws in your region and where you plan to sell.Then, set up tax rates in WooCommerce by navigating to the settings section.You can easily define tax classes, and WooCommerce will calculate taxes for you at checkout based on the customer’s location.

Q: Do I need to hire a tax professional to help with this?

A: While hiring a tax professional can be helpful, it’s not always necessary, especially for small businesses. Many WooCommerce users successfully manage their tax compliance using plugins like WooCommerce Tax or TaxJar, which can automate much of the process. Though, consulting a professional is a smart move if you have complex needs.Q: Can I automate tax calculations in my WooCommerce store?

A: Absolutely! Utilizing plugins like Avalara or taxjar allows you to automate tax calculations based on real-time data. These tools can save you time and ensure accuracy,so you can focus more on running your business and less on compliance.

Q: What about international sales? Do I need to worry about different tax rates?

A: Yes, international sales can complicate things, but WooCommerce can handle it! You can set different tax rates for different countries and regions. Just remember to stay informed about VAT, GST, and other applicable taxes in the countries you sell to. Plugins can also help you manage these international tax requirements effectively.

Q: Are there ongoing costs associated with maintaining tax compliance?

A: While there can be some costs for premium plugins or consulting services, many basic tax compliance tasks can be handled with free or low-cost solutions. The key is to choose tools that fit your budget and scale as your business grows. Investing in good tax tools upfront can save you money in the long run!

Q: What common mistakes should I avoid when setting up my store?

A: A few common pitfalls include neglecting to configure tax settings, failing to update tax rates regularly, or overlooking compliance for international sales. it’s also important not to ignore your digital products, as they can have different tax rules. Stay proactive, and double-check your settings regularly!

Q: any final tips for building a successful, tax-compliant WooCommerce store?

A: Definitely! Always keep your software updated, regularly review your tax settings, and stay informed about any changes in tax laws.Consider joining WooCommerce forums or communities where you can learn from others’ experiences. Remember, staying tax-compliant is an ongoing process, but with the right approach, it’s entirely achievable – and worth it for your peace of mind!

the Conclusion

building a tax-compliant WooCommerce store on WordPress doesn’t have to be a daunting task filled with headaches and confusion. By following the steps we’ve discussed, you can create an efficient online shop that not only meets legal requirements but also minimizes needless overhead costs.

Remember, investing time in understanding the tax regulations and making smart choices about plugins and settings will pay off in the long run. Your customers will appreciate the smooth and transparent shopping experience, while you can focus on what you do best: growing your business.

So, why wait? Dive into your WooCommerce journey today and set yourself up for success. With the right tools and a bit of know-how, you’re already well on your way to creating a thriving, compliant online store. If you have any questions or need further guidance, don’t hesitate to reach out or join the community. Happy selling!