Introduction:

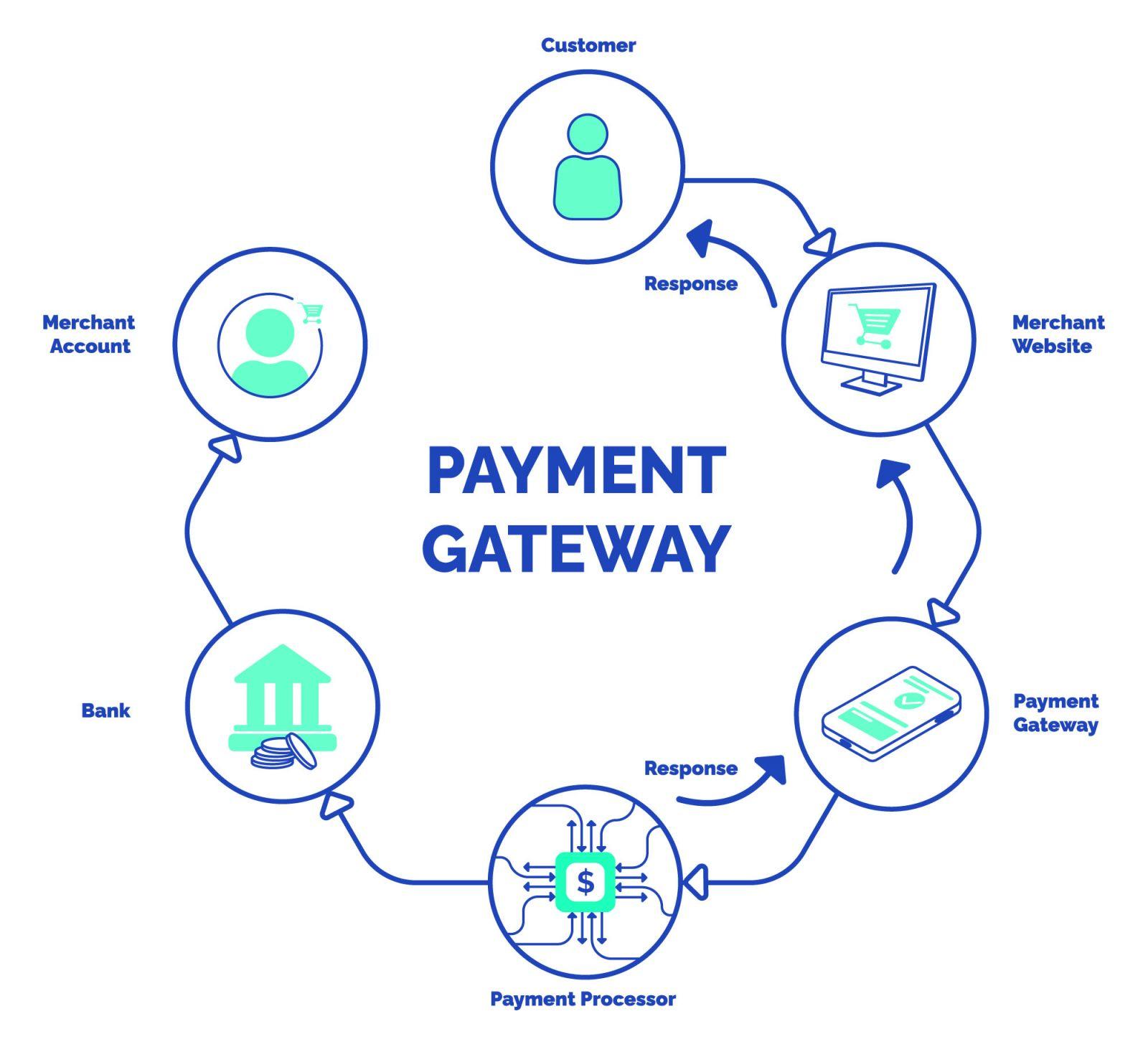

If you’re running an online store on Shopify, you know that seamless payment processing is key to keeping your customers happy adn your sales rolling in. But what happens if shopify Payments doesn’t quite meet your needs? Whether you’re facing high transaction fees, limited payment options, or just want to explore more flexible solutions, you’re not alone. Fortunately, there’s a world of alternative payment gateways out there that can enhance your e-commerce experience and help you maximize your revenue. In this article, we’ll dive into the 6+ best Shopify Payments alternatives that can cater to your unique business needs, offering you more control, better rates, and improved customer satisfaction. Let’s explore how these options can help you elevate your online store to new heights!

Exploring the Need for shopify Payments Alternatives

When operating an online store on shopify, you may find that Shopify Payments, while convenient, doesn’t always meet the needs of every business model. There are several compelling reasons to explore alternatives, from transaction fees to payment processing capabilities. Choosing the right payment solution can not only save you money but also improve your customer experience.

Firstly, transaction fees can eat into your profits considerably. Shopify Payments charges various fees depending on your subscription plan, but using a third-party processor can sometimes provide better rates. This is especially true for larger businesses or those with high sales volume. By opting for an alternative, you can perhaps lower costs and increase your bottom line.

Another factor to consider is payment flexibility. Some alternatives offer a wider range of payment options, including digital wallets, cryptocurrency, and international payment methods. This can be a game-changer if you’re targeting diverse customer demographics or global markets. Customers appreciate having choices, and offering multiple payment options can lead to higher conversion rates.

Additionally, customer support is a crucial aspect of any payment processor. While Shopify has a robust support system, some alternatives specialize in customer service, offering dedicated account managers and immediate assistance. This can be invaluable for resolving issues promptly, ensuring that your business runs smoothly without interruptions.

| Payment Processor | Key Features | Typical Fees |

|---|---|---|

| PayPal | Widely accepted, easy to integrate, buyer protection | 2.9% + $0.30 per transaction |

| Stripe | Customizable APIs, subscriptions, international payments | 2.9% + $0.30 per transaction |

| Square | Point of sale, invoicing, recurring payments | 2.6% + $0.10 per transaction |

| Authorize.Net | Recurring billing, extensive integrations | $25/month + 2.9% + $0.30 per transaction |

Lastly, it’s essential to consider the user experience on your website. A seamless checkout process can significantly influence a customer’s decision to complete a purchase. Some alternatives provide advanced features like one-click checkout, which can enhance user satisfaction and reduce cart abandonment rates. Evaluating these aspects will enable you to choose a payment method that aligns with your business goals while providing an optimal experience for your customers.

Unveiling the Top contenders in Payment Solutions

The landscape of payment solutions has evolved dramatically, offering merchants a plethora of options to meet their business needs. If you’re looking for alternatives to Shopify Payments, you’re not alone. Many businesses are exploring diverse payment gateways that provide flexibility, cost-effectiveness, and unique features tailored to their specific requirements.

Here are some of the top contenders that have emerged as viable alternatives to Shopify Payments:

- PayPal: With its global reach and trusted brand reputation, PayPal remains a popular choice.It offers easy integration, allowing customers to pay with just a few clicks, which can significantly enhance the checkout experience.

- Stripe: Known for its developer-friendly interface, Stripe provides extensive customization options. It supports a variety of payment types, including credit cards and digital wallets, making it a robust solution for growing businesses.

- Square: Square combines online payment processing with point-of-sale solutions, making it ideal for businesses that operate both online and offline. Its transparent pricing and easy setup make it accessible for small businesses.

- Authorize.Net: As one of the oldest payment gateways,Authorize.Net boasts reliability and extensive features,including fraud detection and recurring billing. It’s particularly beneficial for businesses that require advanced payment options.

| Payment Solution | Key Features | Best For |

|---|---|---|

| PayPal | Swift checkout, trusted brand | Global reach |

| Stripe | Customizable API, multiple payment types | Developers & tech-savvy merchants |

| Square | POS integration, transparent pricing | Brick-and-mortar stores |

| Authorize.Net | Fraud detection,recurring billing | Businesses needing advanced features |

Each of these options brings unique strengths to the table,ensuring that you can find a payment solution that aligns with your business model. Whether you prioritize ease of use, advanced features, or cost-effectiveness, these alternatives provide excellent choices that can enhance your customer’s purchasing experience and streamline your operations.

Understanding Transaction Fees: Making the Right Choice

When it comes to running an online store,transaction fees can significantly impact your bottom line. Each payment processor has its own fee structure, which can vary widely depending on the service you choose. Understanding these fees is crucial to making the most cost-effective choice for your Shopify store. Here are some key factors to consider:

- Percentage Fees vs. Flat Fees: Many providers charge a percentage of each sale along with a flat fee. It’s critically important to evaluate how these fees will affect you as your sales volume increases.For lower sales,a flat fee may seem more manageable,while for higher volumes,a percentage fee might be more beneficial.

- Monthly Fees: Some payment processors charge a monthly subscription fee in addition to transaction fees. Consider whether the benefits they offer justify the extra cost, especially if you’re just starting out.

- International Transactions: If your business has a global reach, check the fees associated with international sales. Some providers may charge higher fees for currency conversion or cross-border transactions.

- Chargeback Fees: Be aware of potential chargeback fees, which can occur when a customer disputes a transaction. choose a payment processor with a clear policy on how they handle chargebacks and associated costs.

Another aspect to consider is the ease of integration with Shopify.Some alternatives offer seamless integration, reducing setup time and technical headaches.This could save you valuable time, allowing you to focus more on growing your business rather than troubleshooting payment issues. Look for options that offer:

- User-Friendly Interfaces: A straightforward setup can enhance your experience and minimize complications.

- Robust Customer Support: In case of issues, having reliable support can be a lifesaver. Consider providers with 24/7 support and comprehensive resources.

to further assist you in understanding the landscape of transaction fees, here’s a quick comparison of popular Shopify payments alternatives:

| Payment Processor | Transaction fee | Monthly Fee | International Fees |

|---|---|---|---|

| PayPal | 2.9% + $0.30 | None | Additional 1.5% for currency conversion |

| Stripe | 2.9% + $0.30 | None | 1% for international cards |

| Authorize.Net | 2.9% + $0.30 | $25/month | 1% for international transactions |

| Square | 2.6% + $0.10 | None | None |

Ultimately, the right payment processor for your Shopify store will depend on your specific business needs. Take the time to analyze each option’s fee structure, integration capabilities, and overall value to find the perfect fit for your business. by making an informed choice, you can maximize your profits and streamline your payment processing, allowing you to focus on what you do best: growing your business.

Seamless Integration: Why It Matters for Your Store

In today’s fast-paced digital marketplace,the ability to integrate payment solutions smoothly into your online store can significantly influence customer satisfaction and retention. A seamless integration not only enhances the shopping experience but also builds trust with your customers. When a payment process is smooth,users are less likely to abandon their carts and more likely to complete their transactions.

When considering alternatives to Shopify Payments,it’s essential to look for options that offer easy integration.Here are some key factors to keep in mind:

- user-friendly Setup: Choose payment providers that offer straightforward installation processes, reducing the time and effort needed to get started.

- Compatibility: Ensure that the payment method you select works seamlessly with your existing Shopify theme and apps, preventing any disruptions in your store’s functionality.

- Mobile Optimization: With an increasing number of shoppers using their smartphones, it’s crucial to pick a payment solution that is optimized for mobile use, ensuring a flawless checkout experience on all devices.

Another critical aspect is transaction speed. Customers expect a fast and efficient checkout process. Delays during payment processing can lead to frustration and potentially lost sales. A payment alternative that offers rapid processing times will keep your customers happy and help maintain your store’s reputation.

Ultimately, the goal is to create an environment where customers feel confident and secure while making purchases. By opting for payment alternatives that prioritize seamless integration, you not only improve user experience but also pave the way for increased conversions and customer loyalty.

| Payment Provider | Integration Ease | Mobile Compatibility | Transaction Speed |

|---|---|---|---|

| PayPal | Easy | High | Instant |

| Stripe | Moderate | high | Instant |

| Square | Easy | Medium | Instant |

| Authorize.Net | moderate | High | 1-2 Days |

User Experience First: Payment Gateways That Shine

When it comes to selecting a payment gateway for your Shopify store, the user experience should be paramount. A seamless payment process can significantly influence customer satisfaction and retention. Here are some standout alternatives that prioritize user experience while providing robust features.

- paypal: Renowned for its widespread acceptance, PayPal offers an intuitive checkout experience that many customers trust. With options like PayPal Express Checkout, it allows buyers to complete their transactions without leaving your site.

- Stripe: Stripe excels in developer-friendly features and a customizable checkout process. Its modern interface and smooth integration make it a favorite among tech-savvy businesses.

- Square: Ideal for those also running physical stores, square seamlessly bridges online and offline sales. Its user-friendly dashboard simplifies tracking and managing transactions.

- Authorize.Net: With a solid reputation, Authorize.Net provides robust security features and customizable payment forms, ensuring a trustworthy experience for users.

- Razorpay: If you’re targeting the Indian market, Razorpay’s localized payment options and straightforward setup can enhance your customers’ checkout experience.

- Adyen: Known for its international capabilities, Adyen offers a unified commerce experience, allowing users to pay in their preferred method, which can increase conversion rates.

Each of these gateways comes with unique features that cater to a variety of business needs. Here’s a quick comparison to help you decide:

| Payment Gateway | Key Features | User Experience Rating |

|---|---|---|

| PayPal | Trusted brand, easy integration, mobile-friendly | ★★★★☆ |

| Stripe | Highly customizable, transparent pricing, extensive API | ★★★★★ |

| Square | Integrated POS, inventory management, user-friendly | ★★★★☆ |

| Authorize.Net | Secure transactions, customer support, easy plugin | ★★★★☆ |

| Razorpay | Local payment options, simple setup, quick transfers | ★★★★☆ |

| Adyen | Global payment options, seamless experience, analytics | ★★★★★ |

Choosing the right payment gateway is not just about the features—it’s also about ensuring your customers have a delightful experience while making their purchases. By prioritizing user-friendly options, you can ensure that your Shopify store stands out in a crowded market.

Security Features: keeping Your Transactions Safe

In the ever-evolving landscape of online commerce, ensuring the security of your financial transactions is paramount. When exploring alternatives to Shopify payments, it’s crucial to consider platforms that prioritize safety and protect sensitive details. The best payment processors incorporate advanced security features that can give both you and your customers peace of mind.

Look for payment gateways that utilize end-to-end encryption. This technology scrambles the data during transmission, making it nearly impossible for unauthorized parties to access sensitive information such as credit card numbers and personal details. Additionally,many of these platforms comply with Payment Card Industry Data Security Standards (PCI DSS),which sets stringent requirements for organizations that handle credit card transactions. adopting PCI-compliant solutions can significantly reduce your risk of fraud and data breaches.

Another critical feature to consider is fraud detection and prevention systems. Many advanced payment processors deploy refined algorithms and machine learning techniques to identify suspicious activity in real time. These systems can flag potentially fraudulent transactions and alert you or automatically decline them, ensuring that your business remains protected.

Furthermore, robust customer authentication methods can add another layer of security.look for services that offer two-factor authentication (2FA) or biometric verification options. This means that even if a hacker acquires login credentials, they would still need a second form of verification to access the account, significantly reducing the chances of unauthorized access.

Lastly, ensure that your chosen payment processor provides comprehensive reporting tools. These tools not only help you track transactions but also highlight any anomalies that may indicate fraud attempts. by staying informed and vigilant, you can quickly respond to any potential threats, safeguarding your business and your customers.

Customer Support That Cares: A key Factor in Your Decision

When it comes to selecting a payment solution for your Shopify store, customer support can make all the difference. A responsive and knowledgeable support team not only helps you resolve issues quickly but also fosters a sense of trust and reliability between your business and your customers. Choosing a payment provider that prioritizes customer service can significantly enhance your overall experience and streamline your operations.

Imagine encountering a critical issue during a peak sales period. If your payment processor has a robust support system, you can quickly get the assistance you need. This leads to less downtime and ensures that your customers continue to have a seamless shopping experience. Here are some key aspects you should consider when evaluating customer support:

- Availability: Look for support that is available 24/7. This ensures that you can get help whenever you need it.

- Multiple Channels: A provider that offers support via phone, email, chat, and even social media can cater to your preferred communication style.

- Knowledge Base: A comprehensive documentation library can empower you to solve common issues on your own.

- Response Time: Quick response times can be crucial during high-traffic periods, so consider providers known for their efficiency.

Moreover, a payment provider that genuinely cares about its customers will often go above and beyond. This could mean proactive outreach to help you optimize your payment processes or offering personalized solutions based on your specific needs. Such dedication can provide you with a competitive edge and lead to increased customer satisfaction.

To help you compare various options, here’s a quick overview of some popular Shopify payment alternatives, along with their customer support features:

| Payment Provider | Support availability | Response Time |

|---|---|---|

| PayPal | 24/7 | Within 1 hour |

| Square | Mon-Fri, 9am-9pm | 4-6 hours |

| Authorize.Net | 24/7 | 30 minutes |

| Stripe | 24/7 | 1 hour |

the value of remarkable customer support cannot be overstated. It’s not just about choosing a payment provider; it’s about fostering a partnership that will support your business as it grows. Selecting a provider that emphasizes customer care can enhance your operations and create a better experience for your customers, ultimately leading to increased loyalty and conversions.

Scalability for Growth: Choosing a Payment Solution for the Long Haul

As your business expands, so do your payment processing needs. It’s critically important to select a payment solution that not only meets your current requirements but also scales seamlessly with your growth trajectory. Opting for a versatile and robust payment processor can set the stage for long-term success.

When evaluating alternatives to Shopify Payments, consider factors like user experience, transaction fees, and integration capabilities. A payment solution should provide a smooth checkout experience for your customers, ensuring that they can complete their purchases without frustration. Here are some key aspects to look for:

- Multi-Currency Support: Look for options that allow you to sell globally without conversion hassles.

- customizability: The ability to tailor the payment experience to fit your brand can enhance customer trust.

- Robust Reporting Tools: Insights into transaction data can help guide your business decisions.

- Customer Support: Reliable support can save you time and money in addressing potential issues.

A critical component of any payment solution is its ability to handle increased transaction volumes. In the face of sales spikes during peak seasons or marketing campaigns, ensure that your chosen processor can maintain performance without downtime or delays. It’s also essential to assess security measures, as consumer trust is paramount in e-commerce.

Another vital element is the fees associated with each payment processor. Hidden charges can quickly eat into your profit margins, especially as your transaction volume grows. Always compare fee structures,and choose a solution that balances cost and functionality effectively. Here’s a quick comparison of some popular alternatives:

| Payment Processor | Transaction Fees | Key Features |

|---|---|---|

| PayPal | 2.9% + $0.30 | Wide acceptance, multi-currency support |

| Stripe | 2.9% + $0.30 | Customizable API,advanced reporting |

| Square | 2.6% + $0.10 | Integrated POS, Inventory management |

| Authorize.Net | 2.9% + $0.30 | Fraud detection, recurring billing |

Ultimately, the best payment solution for your Shopify store should align with your business goals and customer expectations. By choosing a processor that not only meets your needs today but is also capable of evolving with you, you can create a solid foundation for growth and success in the long haul.

Real User Reviews: insights from Fellow entrepreneurs

Entrepreneurs love sharing their experiences, and many have found that exploring alternatives to Shopify Payments has been a game-changer for their businesses.Here’s what they have to say:

PaymentFlexibility notes, “Switching to Stripe allowed us to customize our payment processing to better fit our customer needs. The seamless integration made it easy to set up, and the fees are transparent.” This flexibility can enhance customer satisfaction, which is key in a competitive market.

another entrepreneur, JaneD, shared her positive experience with PayPal: “I love how easy it is to use! My customers trust PayPal, and it has improved my conversion rates significantly. Plus, their dispute resolution system is top-notch.” Trust is crucial for online transactions, and PayPal delivers on that front.

A business owner named MarkT expressed his satisfaction with Square: “Not only does Square offer great rates, but their analytics tools have provided insights I never had before.It’s like having a personal finance assistant.” Having access to detailed analytics can definitely help entrepreneurs make informed decisions to grow their businesses.

Many users appreciate Authorize.Net for its reliability. A review from LisaH states, “I’ve never had an issue with downtime, and their customer service is fantastic. It gives me peace of mind knowing my transactions are secure.” Security is a top priority for any online business, and Authorize.Net excels in this area.

here’s a quick comparison of some of the best Shopify Payments alternatives based on user feedback:

| Payment Processor | User Rating | Key Feature |

|---|---|---|

| Stripe | 4.8/5 | Customizable payment options |

| PayPal | 4.7/5 | High customer trust |

| Square | 4.6/5 | Comprehensive analytics |

| Authorize.Net | 4.5/5 | Exceptional security |

These insights from fellow entrepreneurs underscore the importance of choosing a payment processor that aligns with your business needs.Transitioning to a reliable alternative can not only streamline your operations but also enhance your customers’ shopping experience.

Final Thoughts on Choosing the Best Payment Alternative for Your Business

Choosing the right payment alternative for your business is essential in today’s e-commerce landscape. With numerous options available, it’s crucial to consider various factors that align with your business goals and customer preferences.Each payment processor comes with its own set of features, fees, and customer support options, making it imperative to evaluate them thoroughly.

Flexibility is one of the most significant advantages of exploring payment alternatives. Many options allow you to customize the payment experience, integrating seamlessly with your Shopify store.This can enhance customer satisfaction, as buyers can choose their preferred payment method, whether it’s credit cards, digital wallets, or even cryptocurrency.

Additionally, consider the transaction fees associated with each payment processor. These fees can vary significantly, impacting your bottom line, especially as your sales volume increases. It’s vital to analyze the fee structure of each alternative, including any hidden costs, to ensure that your chosen service offers competitive rates.

Another critical factor is security. Online transactions are vulnerable to fraud, making it essential to choose a payment provider that prioritizes safeguarding customer information.Look for processors that offer advanced security features, such as encryption and fraud detection tools, to keep your customers’ data safe and build trust in your brand.

To aid in your decision-making,here’s a quick comparison of some popular Shopify payment alternatives,highlighting their unique features:

| Payment Processor | Transaction Fees | Key Features |

|---|---|---|

| PayPal | 2.9% + $0.30 per transaction | Fast setup, trusted brand, multiple currencies |

| Stripe | 2.9% + $0.30 per transaction | Customizable API, subscriptions, international payments |

| Square | 2.6% + $0.10 per transaction | In-person payments, point-of-sale integrations, free online store |

| Authorize.Net | $0.10 per transaction + monthly fee | recurring billing, advanced fraud detection, customizable checkout |

Ultimately, the best payment alternative for your business will depend on your specific needs and circumstances. Prioritize features that matter most to your customers and your operational workflow. By carefully weighing your options, you can choose a payment processor that not only meets your current needs but also scales with your business as it grows.

frequently Asked Questions (FAQ)

Q: What are Shopify Payments, and why might someone want to look for alternatives?

A: Shopify Payments is Shopify’s built-in payment processing solution that allows merchants to accept credit card payments directly through their online store. However, some users might seek alternatives due to transaction fees, limited availability in certain countries, or the desire for more customization options. Plus, some merchants simply prefer to work with payment processors that align better with their business model.

Q: What are some of the best alternatives to Shopify Payments?

A: great question! here are a few popular alternatives:

- PayPal – Widely recognized and trusted by customers, PayPal offers easy integration and various features.

- Stripe – A developer-friendly option with customizable payment options and advanced features for tech-savvy users.

- Square – Known for its user-friendly interface and comprehensive point-of-sale solutions.

- Authorize.Net – A robust option with extensive features suitable for larger businesses.

- Adyen - Ideal for global merchants, Adyen supports multiple currencies and payment methods.

- Braintree - Owned by PayPal, it offers seamless checkout experiences and is great for mobile payments.

Q: How do I choose the best alternative for my Shopify store?

A: Choosing the right payment processor depends on several factors. consider transaction fees, ease of use, the countries you sell to, and the payment methods you want to accept. Such as, if you want a simple setup with quick integration, PayPal might be ideal. If you’re looking for more customization and advanced features, Stripe could be a better fit.

Q: Are there any hidden fees I should be aware of with these alternatives?

A: Yes, it’s crucial to read the fine print! While some processors advertise low fees, there may be costs for chargebacks, currency conversions, or monthly service fees. Always review the pricing structure to ensure it aligns with your budget and expected transaction volume.

Q: Can I use multiple payment processors on my Shopify store?

A: Absolutely! Shopify allows you to integrate multiple payment gateways. This can be a strategic move to cater to different customer preferences and enhance your checkout experience. For instance, you might use PayPal for its trust factor while also incorporating Stripe for its advanced features.

Q: What are the advantages of using an alternative payment processor?

A: Using alternatives can provide flexibility and potentially lower fees, especially if they offer better rates for your specific business model. They may also provide features that Shopify Payments lacks, such as advanced reporting, fraud protection, or support for international currencies.

Q: Is it easy to switch from Shopify Payments to another processor?

A: Yes,switching is usually straightforward! Shopify allows you to disable Shopify Payments and enable your chosen alternative in just a few clicks. Just ensure you’ve set everything up correctly and tested the new processor to guarantee a smooth transition for your customers.

Q: Any final tips for merchants considering alternatives to Shopify Payments?

A: Definitely! Before making a decision,do thorough research on each option,read reviews,and perhaps reach out to customer service to gauge responsiveness. Also, consider your long-term goals—choose a payment processor that can scale with your business. Remember, the right choice can enhance your customers’ experience and contribute to your store’s success!

Closing Remarks

As we wrap up our exploration of the best Shopify payments alternatives, it’s clear that the right payment solution can significantly enhance your e-commerce experience. Whether you’re looking for lower fees,better integration,or unique features tailored to your business model,there’s a perfect fit out there for you.

Remember, the key to thriving in the competitive world of online retail is flexibility. By considering these alternatives,you not only empower your business but also provide your customers with a seamless and satisfying shopping experience.

So, why settle for the status quo? Take a moment to evaluate your options, test a few out, and see which payment platform aligns best with your goals. After all, making the right choice can lead to happier customers, increased sales, and ultimately, a more accomplished store.

Have you found the perfect alternative yet? Share your experiences or ask questions in the comments below—we’d love to hear from you! Happy selling!